Scalping using price action is a huge rush (and it is very profitable too).

From my 15 years of trading price action on large time frames, I can tell you that dropping down to 5 and 15 minute charts gets crazy.

But price action scalping is also fun, and it teaches you a lot about price action, and Forex trading.

I often say that there are three core skills that you need to master to be a great Forex trader.

- Your trading strategy

- Risk management

- Trading psychology (mindset)

And you know what? Taking my Forex price action strategy from the high hourly charts down to the 5 and 15 minute charts allows you to master these skills much faster.

As good as scalping sounds, it can be nerve wracking, tense, but at the same time it is incredibly rewarding.

So how do you use price action to scalp the Forex market? Well let’s start with the basics.

What is Price Action?

Price action trading allows you to analyse the Forex market without using indicators. Instead of indicators you use candles, support and resistance, and trend lines to make trading decisions.

I won’t cover price action basics here, if you want to learn the basics, check out my free price action strategy.

The point is that price action analysis allows you to predict with a high degree of accuracy what price will do next by understanding who has control of price, buyers or sellers.

If buyers are in control, you want to buy. If sellers are in control, you want to sell. It all seems very simple right? Well, some newbies make price action a lot more difficult than it needs to be.

So let me tell you a secret that will help you be a better price action trader.

Who’s in control of price?

Those four words are vital when trading price action.

If you ask yourself that question every time you look at a chart.

Every time you do your analysis.

Every time you even think about entering a trade.

You will be a better price action trader.

I do most of my trading on larger time frames. And even on those larger time frames I constantly ask myself “who’s in control of price?”; that question saves me from making huge mistakes.

And here is why.

The question only had three possible answers… Buyers, sellers, or price is undecided.

If you spot a short trade which you want to enter and you ask yourself “Who’s in control of price?”, would you enter if the answer is buyers? No, of course not, if buyers are in control you do not want to sell yet.

Asking yourself “who’s in control of price” forces you to think about price objectively. It forces you to properly analyses price. Instead of making a hasty decision, you are forcing myself to make an informed decision.

Now, if I ask myself that question when trading 12 hour charts. Imagine how much more important it is when I am price action scalping a 5 minute chart; when I only have about 30 seconds to make a trading decision.

So, if you want to trade my Forex price action scalping strategy, memorise that question. Who’s in control of price?

Being able to answer that question quickly and effectively is vital. And, it is also very stressful, which brings me to my next point.

You Need The Right Mindset For Scalping

The fact is, if you are a nervous trader, scalping is not for you.

Sorry… That is just the truth.

Forex is not all about having a trading strategy. A trading strategy is important but trading psychology is arguably more important.

You could try my scalping strategy below and completely fail. Even while I am making consistent profits with it.

Why?

Because I have been trading Forex for 15 years, so I have hardened my trading psychology. I can withstand the stresses of Forex price action scalping.

When I was new to trading, my trading psychology was a mess. I would constantly close trades out too early out of fear.

I would let bad trades run in the vain hope that they would come back in my direction.

In short, I did not have a trading plan; and let’s face it, even if I had a plan, I probably would not have followed it.

These days I can handle the stresses of scalping price action. Through years of conditioning, I have toughened my trading psychology. I can trade my strategy with almost no fear. I have the absolute conviction that no matter how many trades I lose, I will always come out ahead.

That is trading psychology.

When I enter a trade I do not freak out because it moves against me a few pips.

If I lose four trades in a row I do not lose faith in my strategy. I stick with it because I know that a few losing trades mean nothing.

So, do you think you can handle the stresses of Forex price action scalping?

If not and if you think you would be better off trading something slower paced for a while. You should check out my normal free price action trading strategy. My normal strategy is traded on larger time frames. There may be less trades but you usually have hours to plan your trade, so much of the stress is removed.

If you think you can handle scalping with price action, keep on reading.

Price action scalping basics

On larger time frames I specialise in reversal trading. I take price action based reversal from areas of support and resistance.

On small time frames reversals do not work very well. This is because reversal trading relies on identifying the precise moment in which a trend dies. On small time frames there is too much noise to effectively identify the death of a trend.

So a different approach is needed for Forex price action scalping.

We will be trading trend continuations. We will be watching for price action signals which indicate a trend is strong. We will then trade a continuation when price pulls back to a area of support or resistance.

This may sound simple but it is very stressful. One key component of this strategy is that you must maintain a risk to reward ratio of 1:3 at a minimum.

So, let’s sum up the basics.

- We will be looking for trend continuations.

- We will enter when price pulls back to our areas of support or resistance.

- We will only enter a trade if our target is 3x larger than our stop.

That third point is the stressful one. When a trade is two pips from target and then reverses five pips… many people just close it out. You cannot do that, you must maintain the 1:3 ratio. Even if it means your stop being hit, you have to stick to 1:3. I will explain this in more detail later.

For now, let’s look at the actual Forex price action scalping strategy.

First we need support and resistance

You will need to draw the support and resistance areas yourself. Don’t worry though, it is very easy.

Let’s start with the two golden rules of support and resistance. These rules do not only apply to scalping Forex price action, they are also used for my normal support and resistance areas:

- Recent data is always more important. Always.

- Body bounces are more important than wick bounces.

Rule one is very simple. When placing support and resistance areas, fresh data is always better than old data. This is even more true on small time frames. Price action formations that occurred twenty minutes ago are more significant than formations that occurred two days ago. So when placing support and resistance, make sure you prioritize recent data.

Generally I only look at the last .

Rule two may be a little harder to understand. I will explain it in more detail in the examples below.

Let’s break support and resistance placement down into a three step process.

Step 1: Identify bounces

The first step to placing support and resistance is to identify bounces on your chart. Ideally you will want several bounces that line up nicely.

Below is an AUD/USD 5 minute chart. I have highlighted three sets of obvious bounces. The lower set mark out a support area, they are highlighted green. The higher set mark out a resistance area, they are highlighted red.

Bounces will not always be this obvious. However, the more obvious the bounce the stronger the area; so you should only try to identify the most prominent bounces.

Step 2: Draw a horizontal line and connect the bounces

Once you identify several bounces, draw a horizontal line between them and join them. You can see the AUD/USD image from above with support and resistance areas now placed.

It is really that simple. You look for strong bounces and place lines there.

Support and resistance can be more complicated on larger time frames. However, on 5 minute charts, it really is easy.

Now remember rule two? Body bounces are more important than wick bounces?

You will notice in the image above I place my line at the candle bodies, not at the wicks. I do not like placing support and resistance at the wicks. I prefer to have my support and resistance where candles are likely to form.

I am considering adding a video on support and resistance placement. Feel free to send me an email to let me know if you need a video to clarify this subject.

Second you need to know how to spot a setup

You should now have a good understanding of how to place support and resistance areas. The next step is actually finding trade setups. And I am going to show you exactly how to do that.

There might be a small problem though. If you do not understand candlestick pattern and trend basics, the stuff below might not make sense.

If you find that your are struggling with the concepts below, jump over to my price action basics in the Forex education section. In there I cover basic price action and candlestick pattern concepts. Once you understand those concepts, the stuff below will be easy.

What a trend continuation looks like

I am sure you have heard the old saying, “the trend is your friend”. Well in this case, that saying is kind of true. We want to use price action to determine the trend, get a good entry and ride it for a short while.

You should already know how to identify a dominant trend, I talk about this in the education section linked to above.

But the thing about trends is that they are rarely, if ever, smooth. If sellers control price for 24 hours on a five minute chart (288 candles) price won’t move down smoothly every candle for 288 candles. Trends move like this:

See how buyers push back up to the former support after sellers break through it? (marked in green)

That is how a trend works. In a bearish trend, sellers are in complete control of price. Buyers try to take control all the time. Sometimes buyers take control briefly but sellers regain control and continue trending down.

Here is an example of how trade continuation scalps play out. The image below is a gif, it will play like a video and show you how trade continuation trading works.

The basic concept is to trade with the trend. Using candlestick analysis with support and resistance allows you to determine if the trend is still alive. If the trend is still alive, you enter a trade for a quick 10-20 pips. Now, let’s look at some detail trade examples.

The Forex price action scalping strategy

You now know how to place support and resistance areas. You also know what a trend continuation looks like.

All you need to do to trade this strategy is put these two things together. I am now going to show you how to do this with a lot of examples. We will start with and AUD/USD short trade:

In the image above you see AUD/USD is in a downtrend. An area of support is placed at 0.7633 based on the bounces marked in green.

Sellers manage to break support at 0.7633. Buyers take brief control of price and push it up to the former 0.7633 support area.

Buyers make several attempts at closing above the 0.7633 area. Since buyers cannot close above the 0.7633 area, a short trade is entered. The short is entered because price is trending down and it is clear buyers cannot regain control of price.

That is a trend continuation.

Why is the setup above a good trade? Well, let’s do some quick and simple risk analysis on the setup. This analysis would be done when price hits the resistance area and struggles to break above it.

- The major trend is bearish, this indicates sellers are in control of price (one point for sellers)

- Buyers caused a minor reversal back up to resistance, this indicates that buyers have some power (one point for buyers)

- Price is at a strong area of resistance (one point for sellers)

- Buyers are incapable of closing above the resistance area (one point for sellers)

Sellers have three points, buyers have one point. This risk analysis is basic, we could do more complex risk analysis but a strategy like this does not need it.

The idea here is simple. You are using price action analysis to make an educated guess as to what will happen next. If sellers have control of the major trend and buyers cannot close above resistance, the bearish trend has a good chance of continuing. So, you make an educated guess that sellers will continue and you short, why is this profitable?

The key to this strategy

While making an educated guess about price works well on the 5 minute chart, it is obviously not perfect. You will find that you are right 50%-60% of the time.

However, being right does not matter at all. Remember how I said that your risk to reward ratio must be 1:3 at a minimum?

Trading with the bare minimum of 1:3 risk to reward, you need to be right only 25% of the time to break even. If you are right 33% of the time, you are making profit.

My actual risk to reward ratio with this strategy averages out to 3.7 as some trades have a 1:5 ratio. That almost means that I can be wrong 75% of the time and still break even.

The mathematics is on your side with this strategy. You use your understanding or price action to make an educated guess. As long as that guess is right 50% of the time, you should make profit.

As long as you manage to actually stick to the 1:3 risk to reward ratio, you should do well.

That is the problem though. If your trading psychology isn’t good, you will probably mess up the most important part of this strategy, risk to reward ratios.

Pairs and spreads

The pairs you trade will usually be determined by their spreads. The common stop loss for this strategy is 5-10 pips. So you need to trade pairs with very tight spreads to be profitable.

Your spread must be included in your stop. With a two pip spread, you would end up having a three pip stop on some trades, which is simply not viable.

Here is a list of the pairs I trade with this strategy.

- EUR/USD

- GBP/USD

- AUD/USD

- GBP/AUD

- USD/CAD

- USD/JPY

There are of course other pairs with tight spreads. However, I stick to the ones above as they work best for me.

Examples, examples, examples!

Okay, time for some example trades. These trades are all recent and they were either taken by me or members of the advanced course forum.

I am going to try and shoot some live trade videos for this strategy soon. When I do I will post them here.

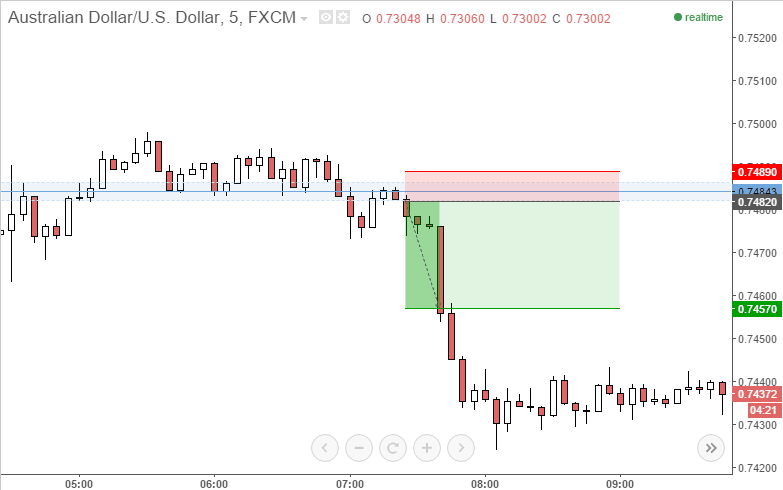

AUD/USD short trade

This was a very simple set up which formed on strong area of resistance. You can see clear bounces from the 0.7485 area over the course of ten hours. These bounces showed me obvious resistance in the area. Price eventually broke above the resistance area and resistance became support. There was actually a failed trade here which I will discuss later.

The short trade was taken after price broke below the 0.7485 support area. After the break, buyers pushed back up the the 0.7485 and tried to close above it. The fact that buyers could not close above the 0.7485 indicated that sellers were in control of price and that the bearish trend would continue.

A short trade was entered at 0.7482 at 07:25am UK time. The stop was 7 pips and the target was 21 pips. As you can see the target was easily met. The trade target was extended by 4 pips to 25 pips as there was great momentum. The overall risk to reward for this trade was 3.57, which is above the minimum of 3.

AUD/USD long trade

This trade triggered a few hours before the trade above. The set up was good but the trade never took off. The support and resistance area was placed at 0.7485 based on the first two bounces show in the image for the previous trade. When buyers broke above resistance price quickly dipped back down to test the area.

Sellers could not close below the area so a long was entered at 0.7488 at 5:50am. The trade’s target was 21 pips and the stop was 7 pips. This trade remained open for over an hour but in the end price dropped and hit the stop.

Could I have done something differently to save myself from taking a 7 pip loss on this trade? Maybe I could have, but it does not matter.

The key to trading this strategy is to just take the trade and let it play out. DO NOT close trades early and DO NOT widen your stops. If the trade fails it does not matter, all that matters is that you maintain a minimum of 1:3 risk to reward ratio.

If you take one hundred trades with this strategy and fail 60% of them you will still be profitable, have a look:

60 trades x -7 pips lost = -420 pips

40 trades x 21 pips won = 840 pips won

840 – 420 = +420 pips up

This is why it is vital to maintain a risk to reward ratio of 1:3 and this is why losses like the one above do not matter.

Trading Forex is not about being right, it’s about being profitable.

Let’s look at another recent example.

USD/CAD short trade

This recent trade example really illustrates why this strategy can be psychologically tough. It also shows you why you must stick to the 1:3 ratio, no matter what.

As you can see, the trade was open for only 10 minutes before price retraced to the entry. How do you handle this situation? Do you panic and exit? Do you calmly decide the trade is no longer good and exit?

NO!

You hold the trade. You need to trust your price action analysis and stick to the 1:3 ratio. Trades like this are quite common, trades will not always hit your target within 20 minutes. You need to be prepared to wait it out sometimes.

Stops and Targets

Stops and targets are pretty simple. Generally my stop is 5 pips and my target is 15 pips. If a pair is moving fast and a 5 pip stop is too tight, I may extend my stop to 10 pips and my target to 30 pips.

Targets and stops are the most subjective part of this strategy. You should stick to a 5 pip stop and 15 pip target when you first start. As you become familiar with the strategy you will understand when to use a slightly larger target and stop.