Forex traders are always on the lookout for how to find a good trade entry. If this already makes you wonder what I’m talking about, here’s a quick explanation of what a trade entry is.

A trade entry is the price point where you would buy or sell a currency pair to achieve a profitable trade that has the best risk-reward ratio you’re looking for.

As such, making sure your entries are good will help make your trades more profitable. Here are some things I look for to find that perfect entry point.

How to find a good trade entry

1. Look for strong price action

When you are looking for a good trade entry, it is important to look for strong price action. This means that the currency pair is moving in a clear and decisive manner.

My strategy is based on the price action you see on top of support and resistance areas. We really want to see clear indecision before opening a trade.

If there is no support or resistance and price isn’t stalling, we do not enter a reversal trade. On top of that, if there are more than 3 indecision candles in a row I will not take a reversal trade either.

To me, 3 or more indecision candles in a row tell me there is too much indecision. It could go either way at that point. More often than not I will wait to see if we could get a continuation set-up instead of a reversal in a case like that. To learn more about my strategy, check out the free course.

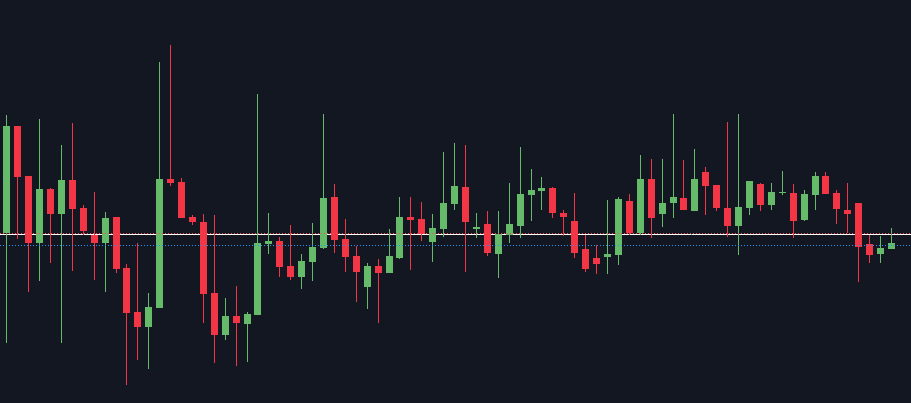

Messy price action is another reason not to enter a trade.

What does messy price action look like? Let me show you instead of trying to explain:

When price action looks like this, it simply does not give me confidence that my entry will be any good. Yes, price might be on a support/resistance area and yes we might see every other signal that we look for to enter a trade. But the messy price action turns me off.

If it doesn’t look good, just don’t take it.

2. Find confirmation on multiple timeframes

A trade entry might look good on one timeframe, but be absolutely terrible on another. You want to make sure you double-check the timeframes.

If you are taking a trade on the 4hr chart it is important to go down to the hourly to check if your entry is on top of a support/resistance area. Placing your entry there could mean you get stuck in a trade that will range for a while. However, an hourly support/resistance area doesn’t mean all that much if you are taking the trade on the daily.

On the contrary, if you see nice indecision on all the timeframes you usually check, that’s a great indicator that you have a good trade entry.

3. Understand the current market structure

Being aware of the general market structure will help you take better trades.

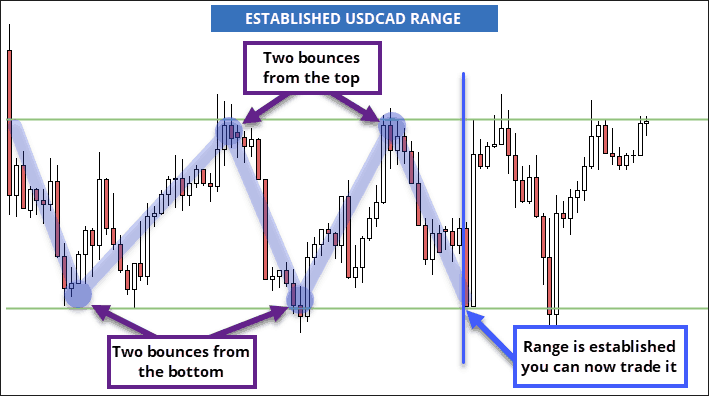

Rangebound pairs are great to trade! Especially if range lows and range highs have proven to be strong. Longing and shorting at those support and resistance areas most likely will end up more profitable than trying to trade a breakout. A good trade entry when price is hitting those key support/resistance levels. Here’s an example of what a range looks like:

At the same time, the trend is your friend! If the market generally has been bearish, a short entry on top of resistance is more likely to end up being profitable than a long entry on support and vice versa. Bullish trend = longs more likely to succeed. Why? Because of the trend.

This is how being aware of the general market structure will help you take better trades and get better entries.

4. Don’t ignore news

No matter how perfect a trade looks it’s never a great entry if CPI data is about to come out. I know there are traders out there who trade the news, but I don’t. CPI data is just one example. I use forexfactory to stay on top of important news that could be coming out.

There will always be another trade, so risking it during a time with guaranteed volatility is an unnecessary risk to take. Nobody can predict which direction the move will go, so more likely than not you will get stopped out.

5. Use price alerts and orders to get a good trade entry

Using price alerts and limit orders are great tools to help you get that perfect trade entry. They will allow you to step away from your charts and take emotion out of trading.

After you’ve identified an entry point, put in your trade as a limit order and it will get entered automatically for you. Just remember to take spreads into account!

If you don’t like using orders, then set a price alert so you can enter the trade manually. The downside to this is that you might not be able to enter it when it happens or you will look at the chart and your emotions will stop you from entering it.

Conclusion

These 5 tips will help you find a good trade entry:

- Look for strong price action

- Find confirmation on multiple timeframes

- Understand the current market structure

- Don’t ignore the news

- Use price alerts and limit orders to get a good trade entry

Feel like you’re already getting top-notch trade entries and want to up your trading game? Take my funded trading challenge now!