Hello guys, welcome to this weeks market analysis where we cover the setups that we are looking at for the upcoming week.

WEEKLY MARKET ANALYSIS AND SUMMARY:

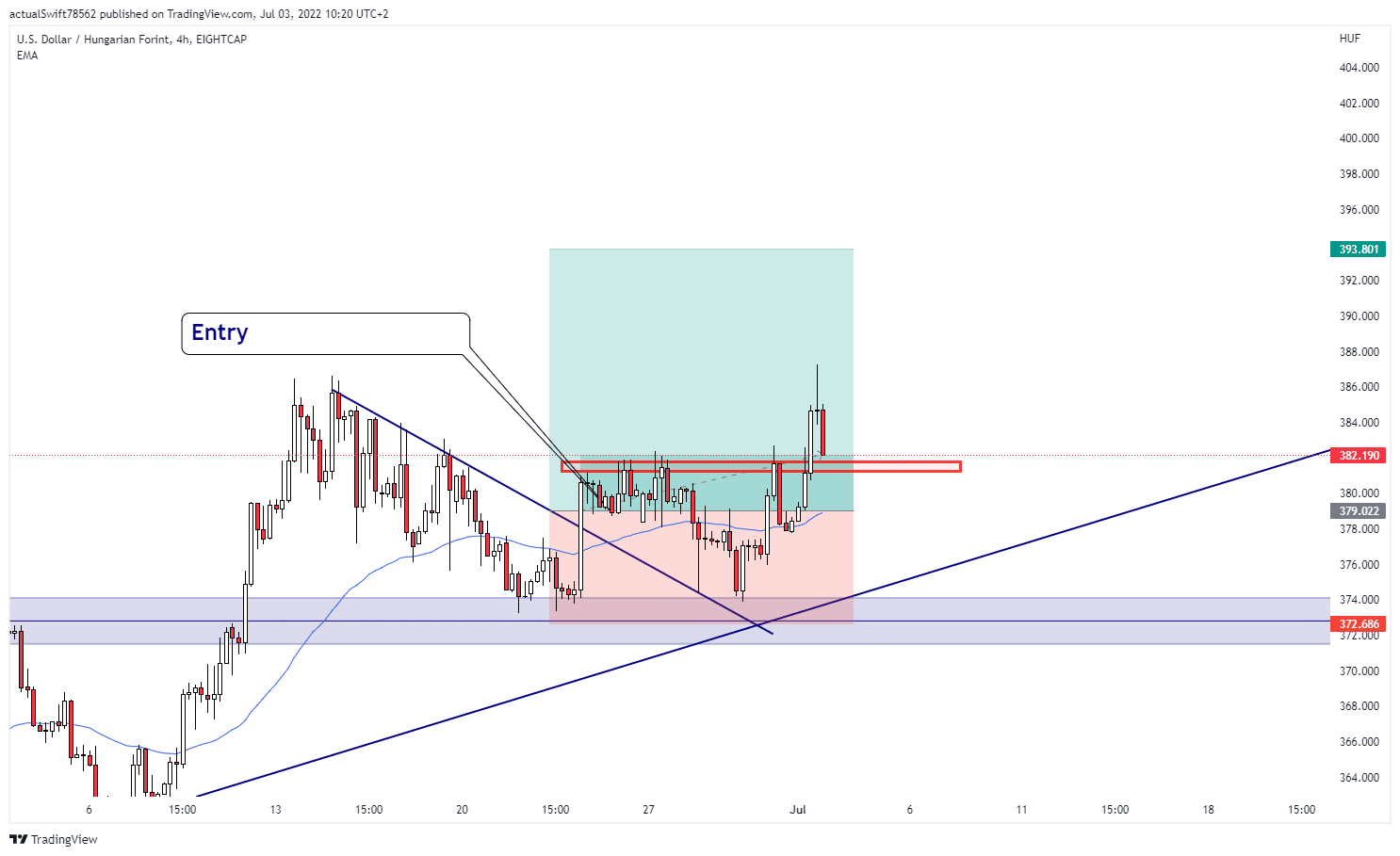

USD/HUF Active Trade Update:

We entered this trade on a slight pullback after the price broke the 4h trendline. At first the price went against us, but patience pays off and we’re in the green now. Our stop-loss is already at BE so this trade is risk free.

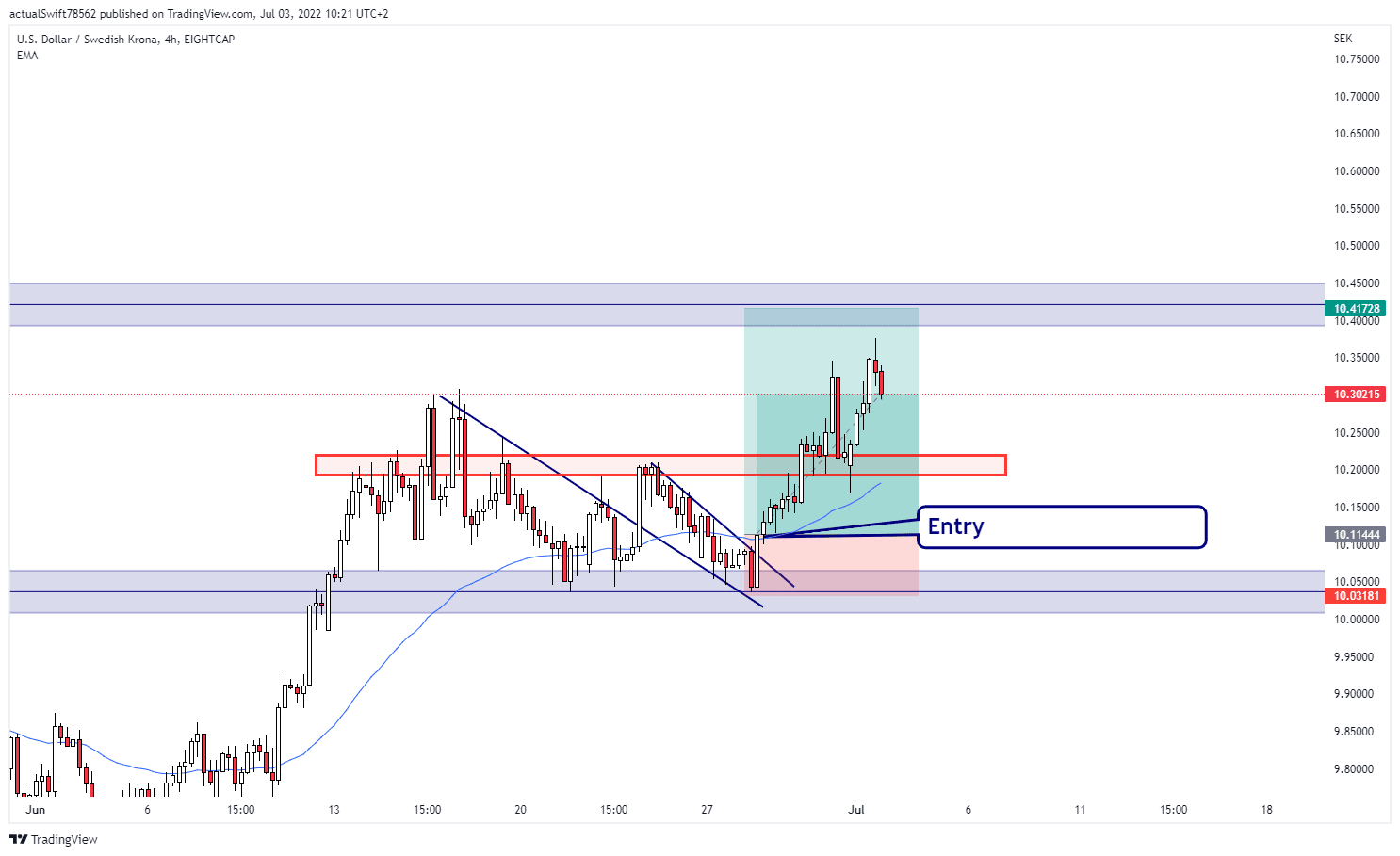

USD/SEK Active Trade Update:

This is another trade we entered last week. We had more luck with this one. The price shot up right after our entry and has been in the green since. Our stop-loss is moved to roughly 1:1 making this trade guaranteed profit.

All in all, last week was very successful for us, hopefully the price doesn’t stop there and goes up further.

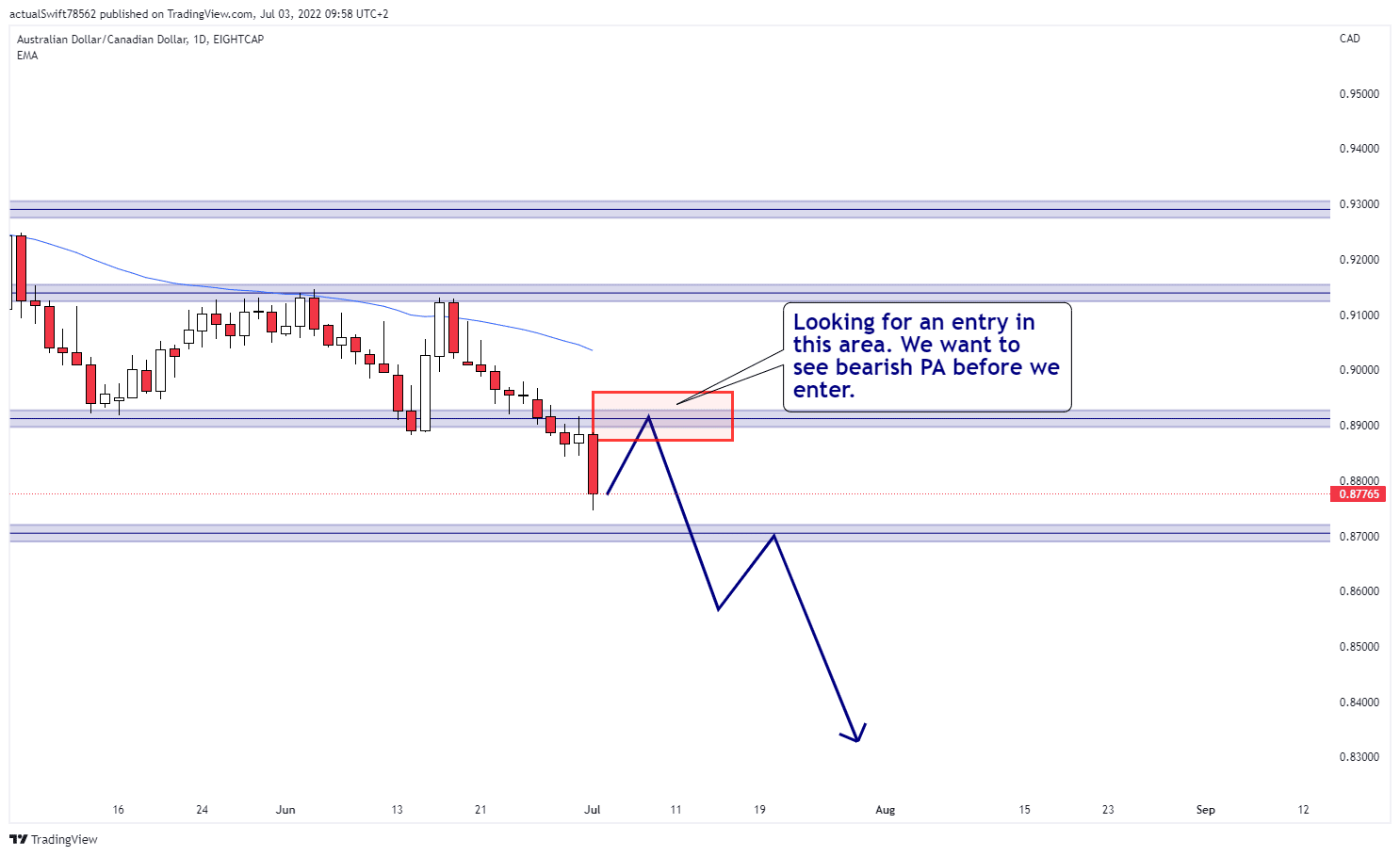

AUD/CAD Potential Trade:

This is a simple breakout, pullback and continuation trade short.

The price broke below the support area and we are now waiting for a pullback and bearish PA on the S/R area for a potential entry short.

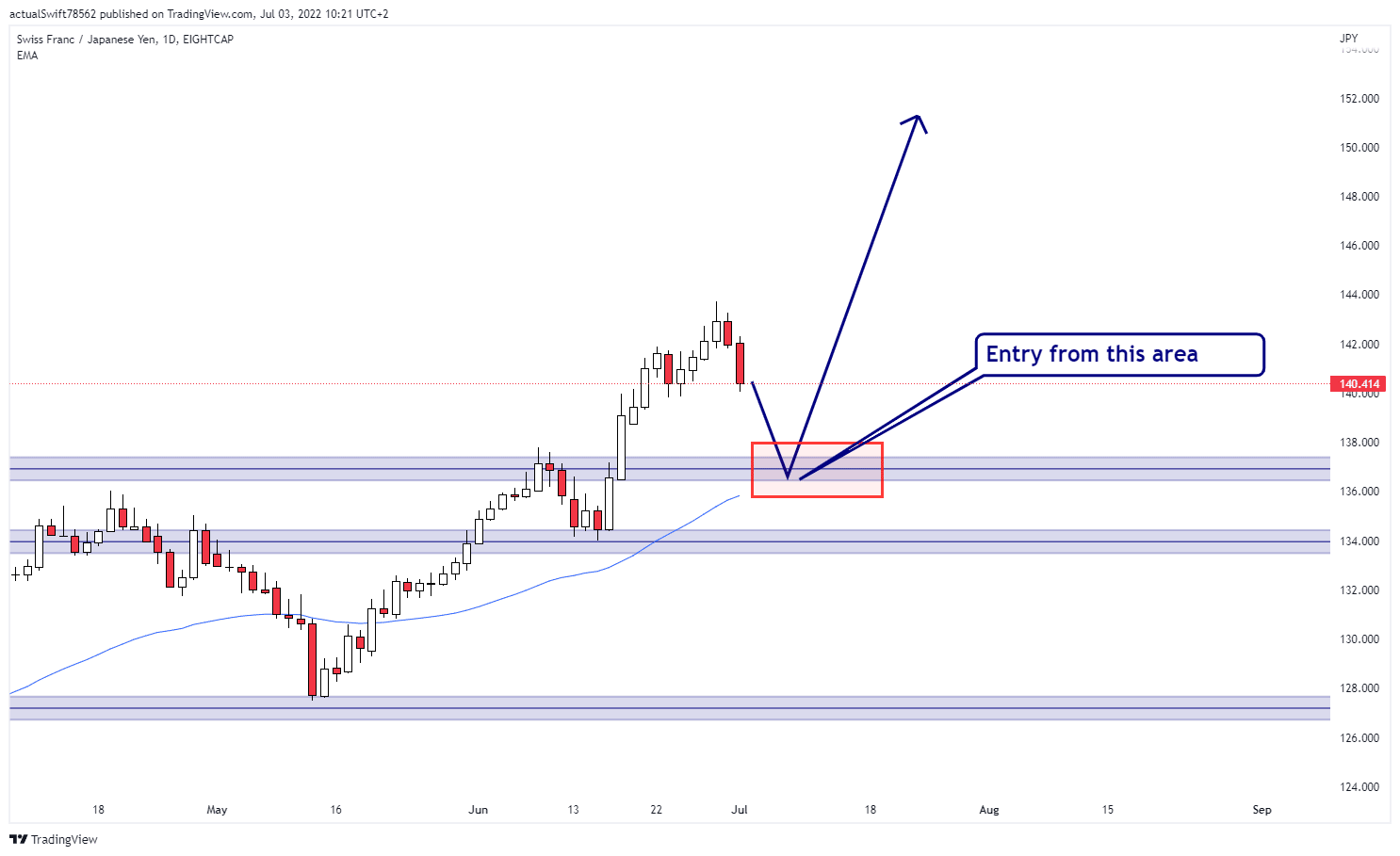

CHF/JPY Potential Trade:

Our next setup is a continuation trade long. The price broke the resistance area and is now making its way back down. If the price reaches the S/R we’ll look for a potential entry long if we get bullish PA. The price would also align with the 50 EMA making it a stronger area to trade from.

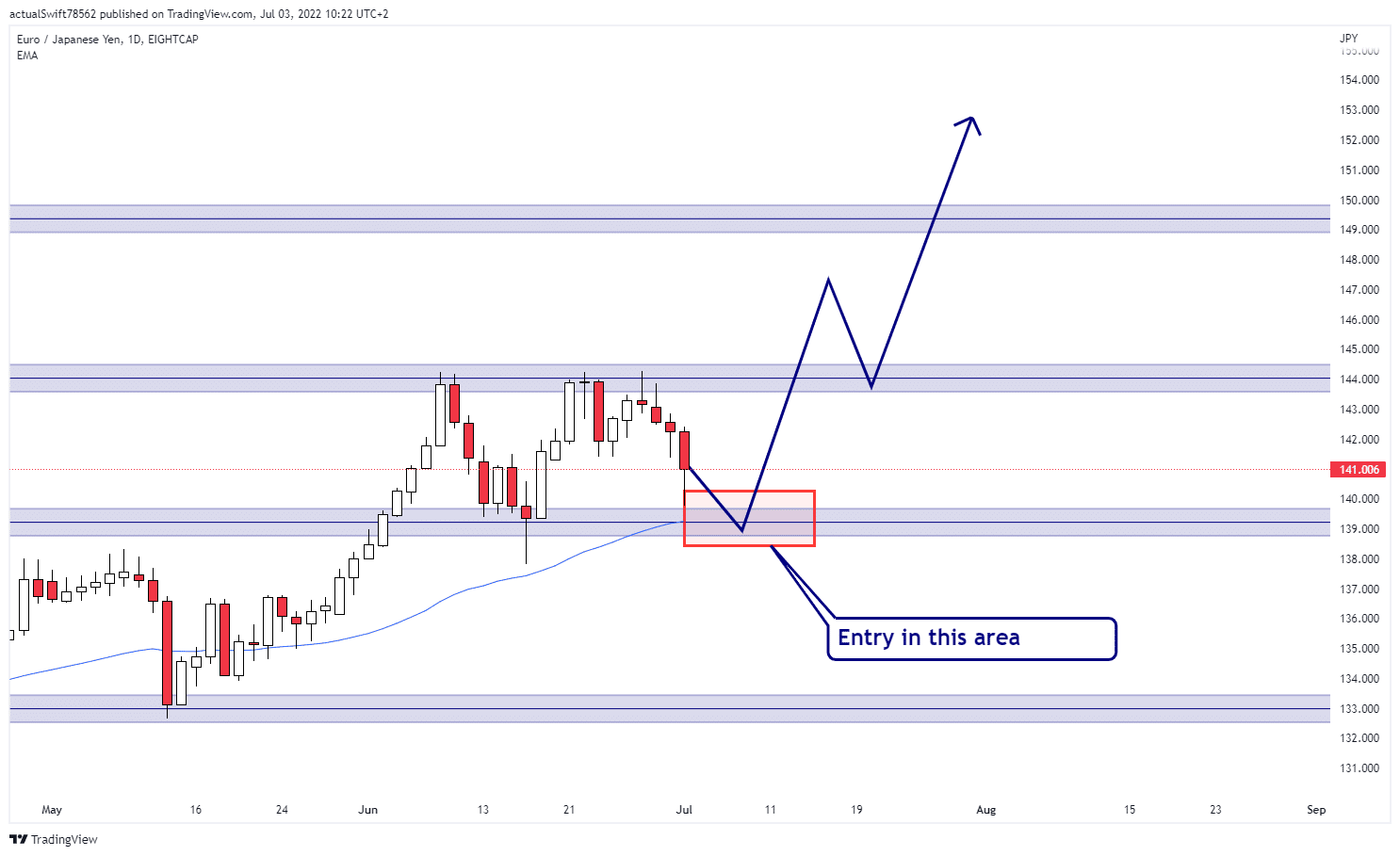

EUR/JPY Potential Trade:

This is a potential range trade in an uptrend. Even though it’s a range, it’s overall in an uptrend which is why we are only interested in trading long trades.

As the price is making its way down we are already seeing long wicks forming which are a sign of bullish presence. Hopefully the price can push all the way down and give us bullish PA for an entry. The price would also align with the 50 EMA.

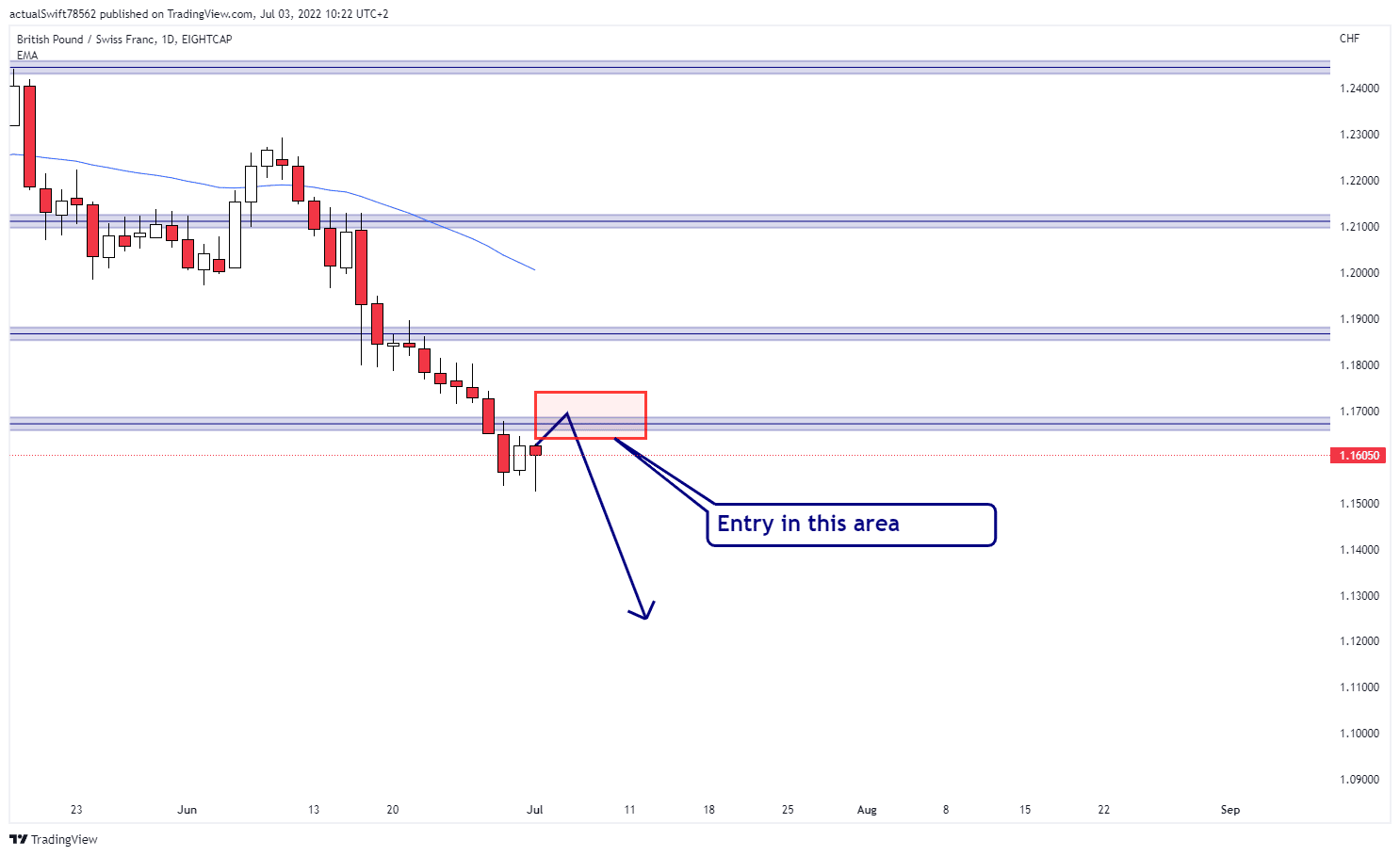

GBP/CHF Potential Trade:

This is another continuation trade short. The price broke the support area and is now making a pullback. We’ll wait for the price to reach the S/R area and form bearish PA for a potential entry.

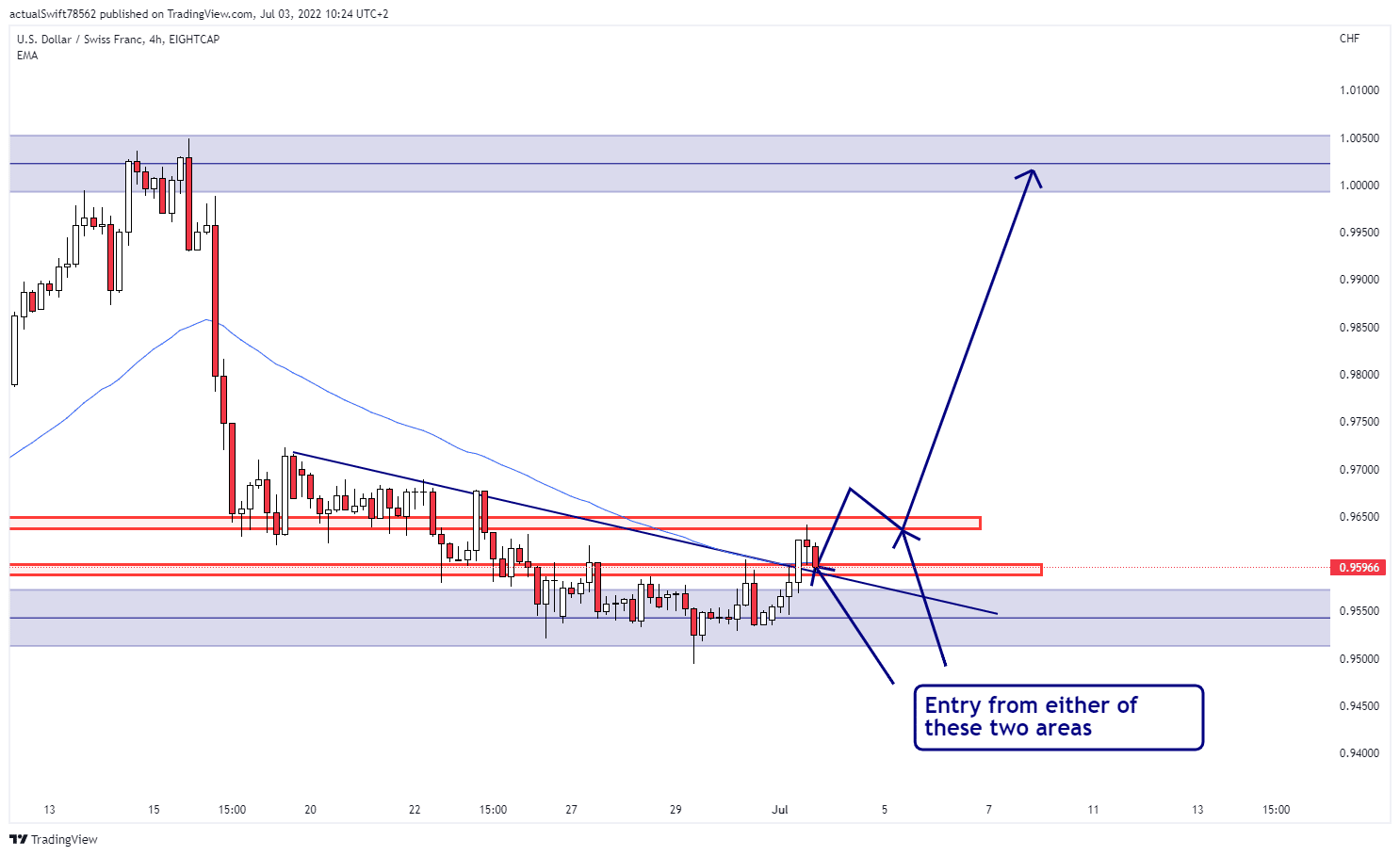

USD/CHF Potential Trade:

This is another range trade.

Usually we wouldn’t consider this as a trade. The price is not giving us convincing bullish price action, but if we look back, we can see that the price did the same thing there. It hit the support area with strong momentum, the price trended sideways and it bounced back up with strong momentum.

Because PA is hard to read on the daily, we’ll jump down to the 4h timeframe where we’ll look for an entry.

On the 4h timeframe we marked out two 4h S/R areas which are going to be the areas we look for an entry from. We’ll decide which one we enter from based on the PA we get next week.

Daily:

4h:

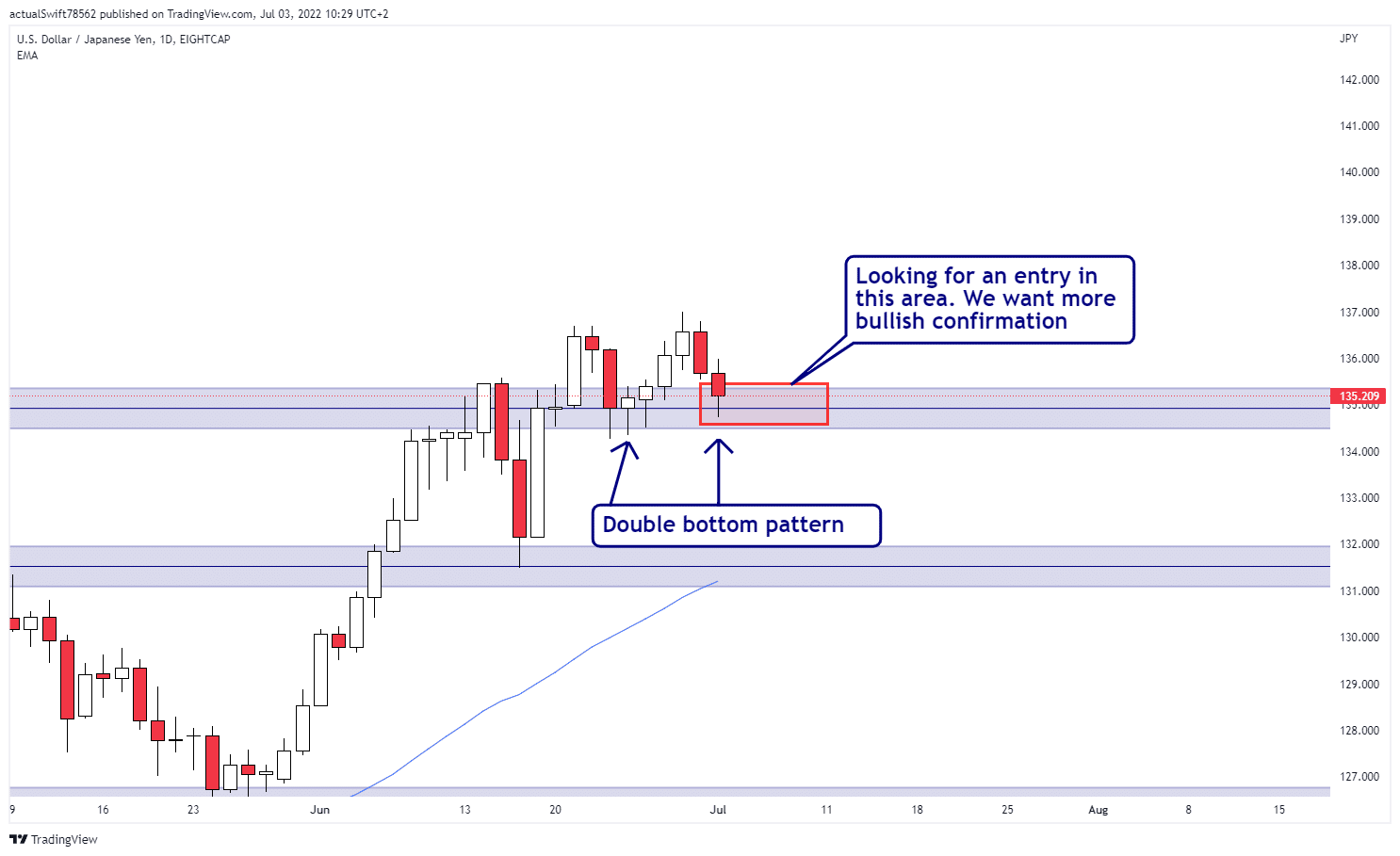

USD/JPY Potential Trade:

This is yet another continuation trade long. The price formed a double bottom pattern which is a bullish pattern. We’ll look for slightly more convincing bullish PA (long wicks rejecting the area) before we look for an entry.

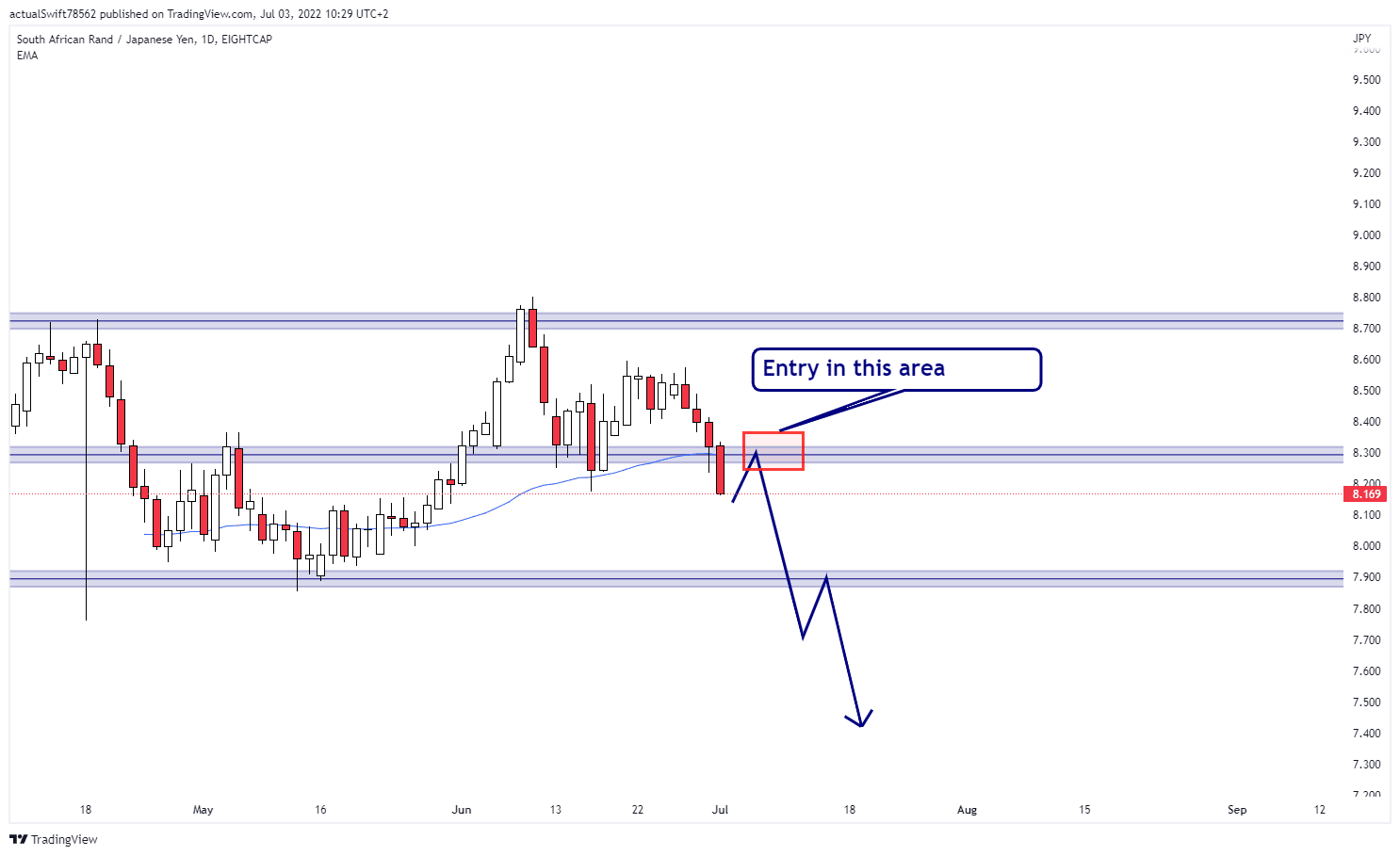

ZAR/JPY Potential Trade:

And our last potential setup is ZAR/JPY. Here we got a break below the support area, now we are waiting for a pullback in combination with bearish PA for a potential entry. The price would also align with the 50 EMA.

If you want to stay up to date with how we play out these trades, or you just have questions to ask us, join our Premium Discord server here: https://discord.gg/45TeSmBNKj

We’re looking forwards to seeing you!