Hello guys, welcome to this weeks market analysis where we cover the setups that we are looking at for the upcoming week.

Weekly trade ideas and analysis:

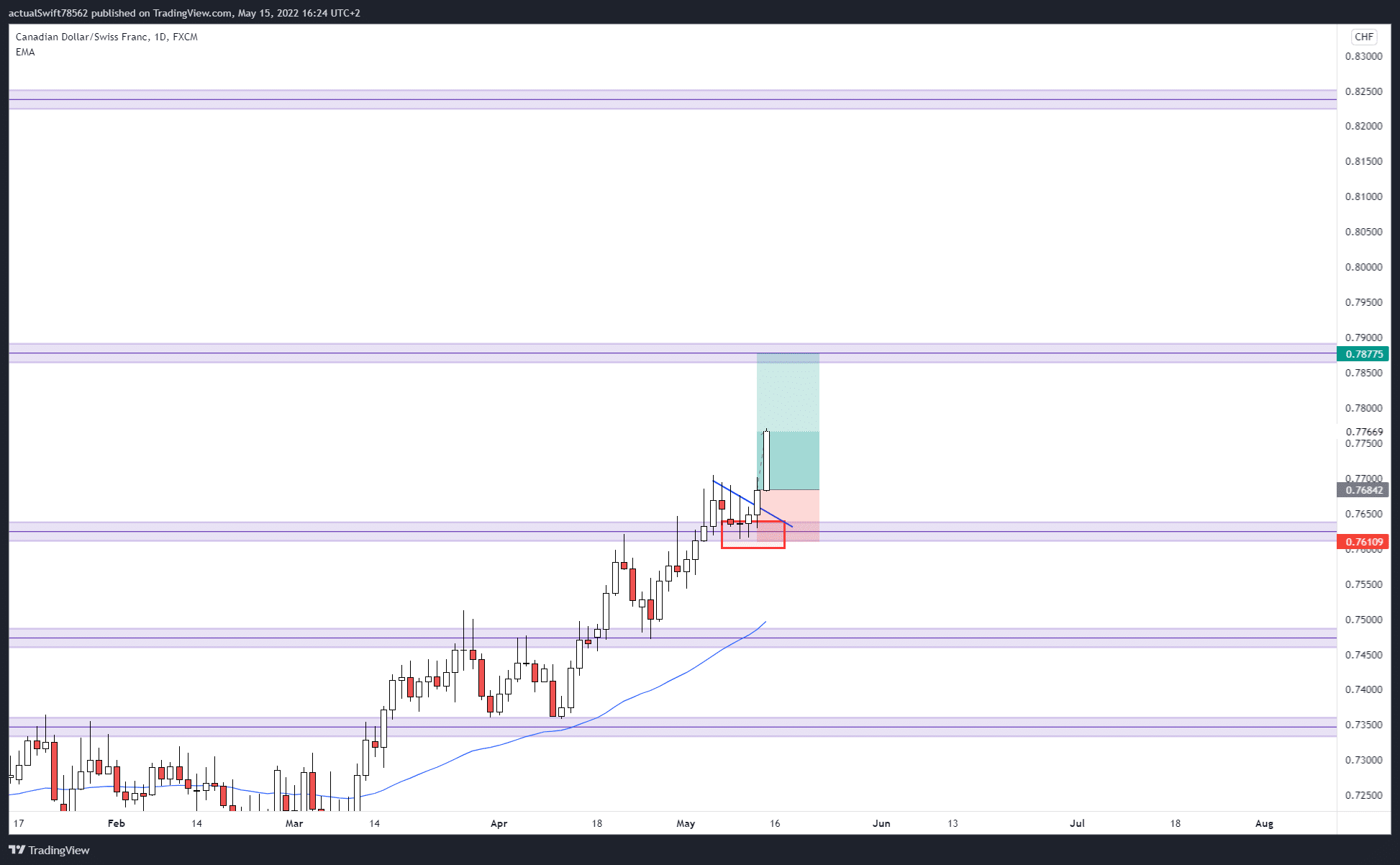

CAD/CHF:

Our first setup that we’ll look at is going to be an active trade from last week.

This is a continuation trade long that we pointed out in the last analysis. This setup formed almost perfectly.

On the daily we got a breakout and a pullback with long wicks rejecting the area. That pullback formed a triangle pattern on the 4h timeframe.

Once that pattern was broken we entered the trade on the 4h timeframe.

Daily:

4h:

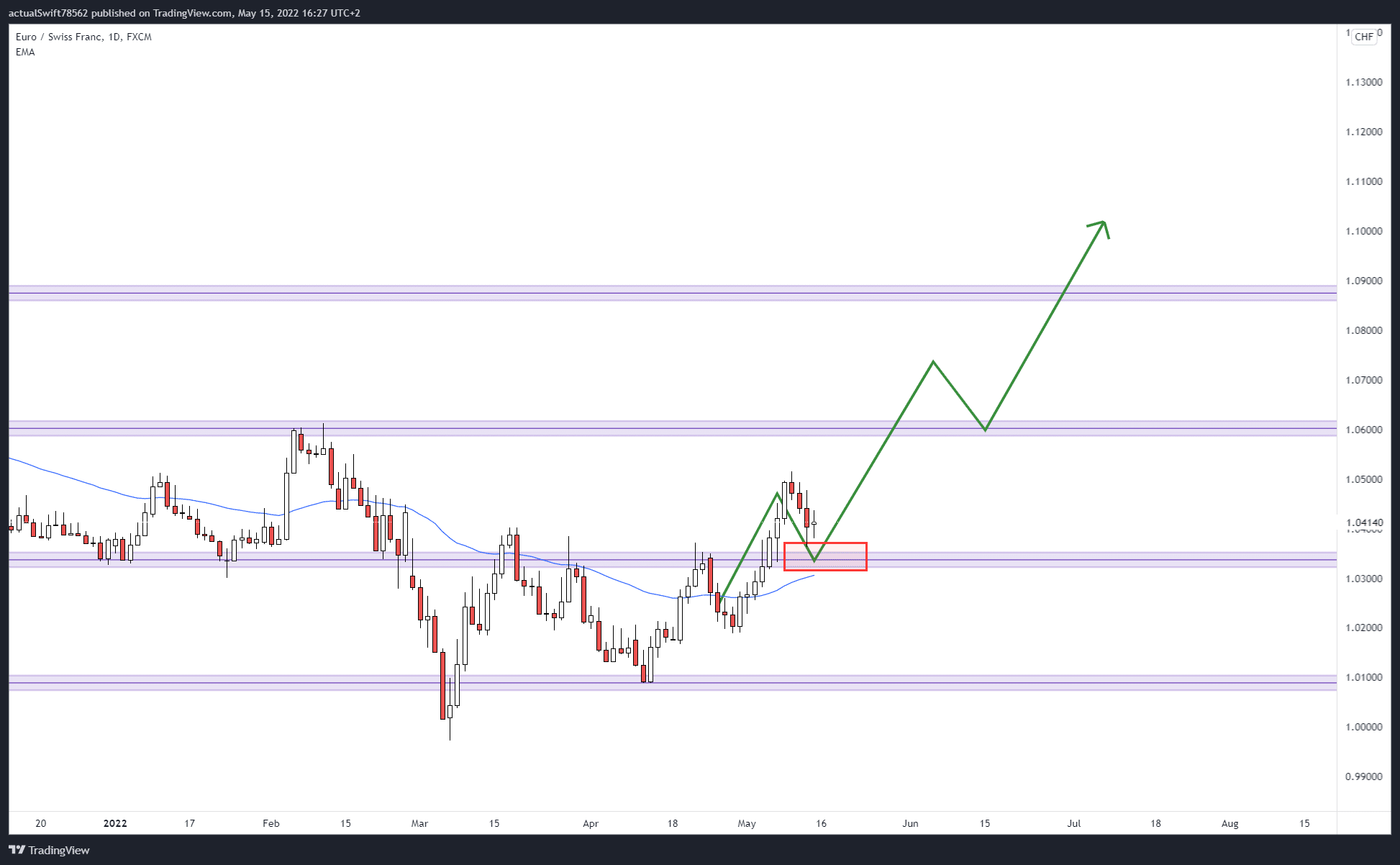

EUR/CHF:

Now to the first potential setup of the week. This week we got 3 setups, but they all include the EUR so we suggest you only enter one or spread your risk amongst them.

This is another breakout and continuation trade. The price broke the resistance area and now we are waiting for a pullback for a potential entry long.

As we are already in a CHF trade, we most likely won’t enter this one, even if the price action forms. But, if you are not in the previously mentioned active trade, then this should be a valid trade setup for you.

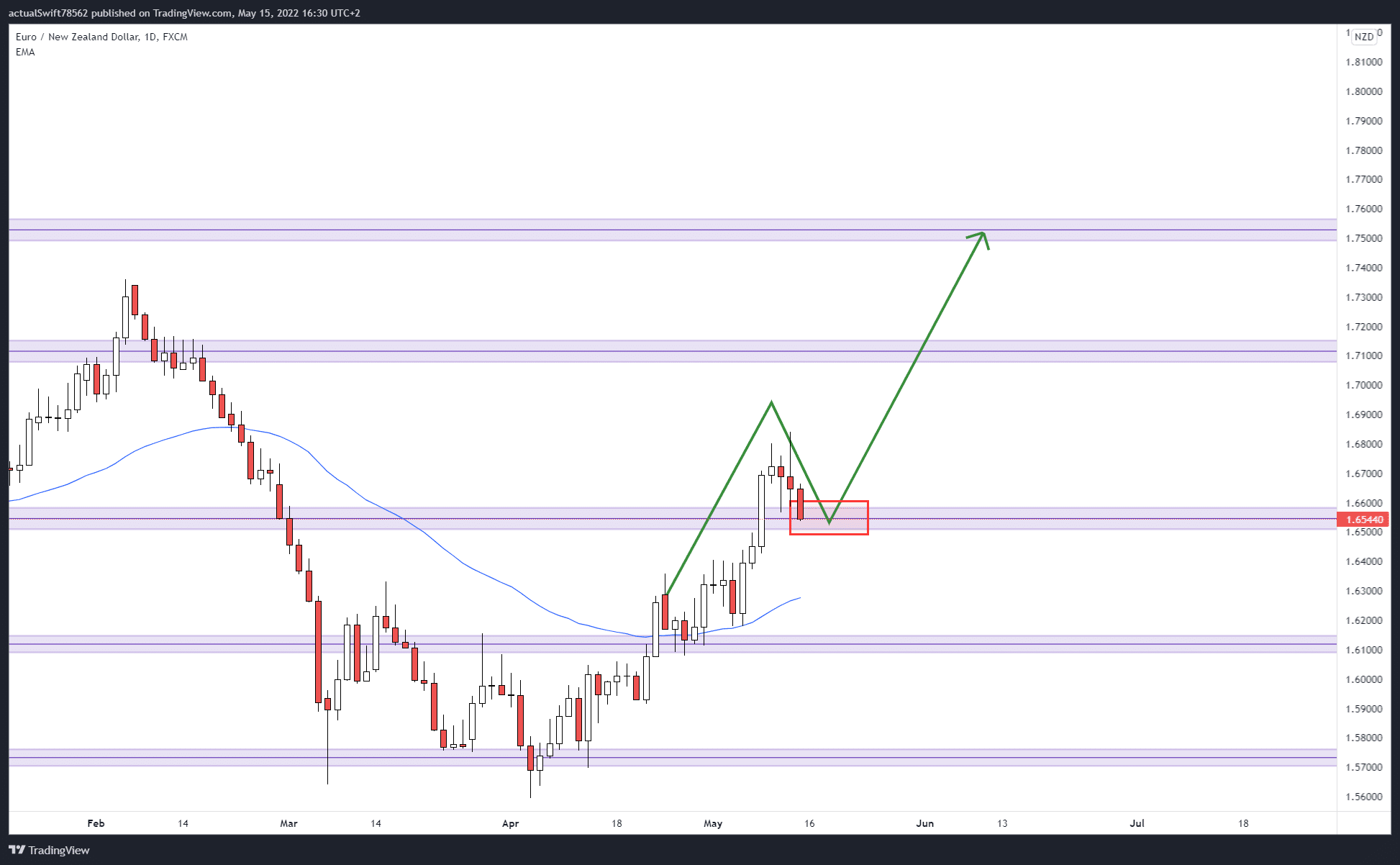

EUR/NZD:

As these are all EUR pairs and will likewise all be continuation trades.

We saw a breakout of the resistance area. The price is already making a pullback so we’ll wait for bullish price action before entering a trade long.

EUR/USD:

The last setup is a bit tricky. Both the previous pairs were continuation trades long, but this one is a continuation trade short. We have to be extra careful to not get caught on the wrong side of the market with these EUR trades. We want to wait for clear price action before entering any of these setups.

We saw the price break below the support area and now we’re waiting for a pullback and a potential entry short with sufficient price action.