Hello guys, welcome to this weeks market analysis where we cover the setups that we are looking at for the upcoming week.

Weekly trade ideas and analysis:

The forex market was very slow this week and we didn’t spot any potential setups.

But, we won’t leave you empty handed so we’ll go through two potential STOCK setups.

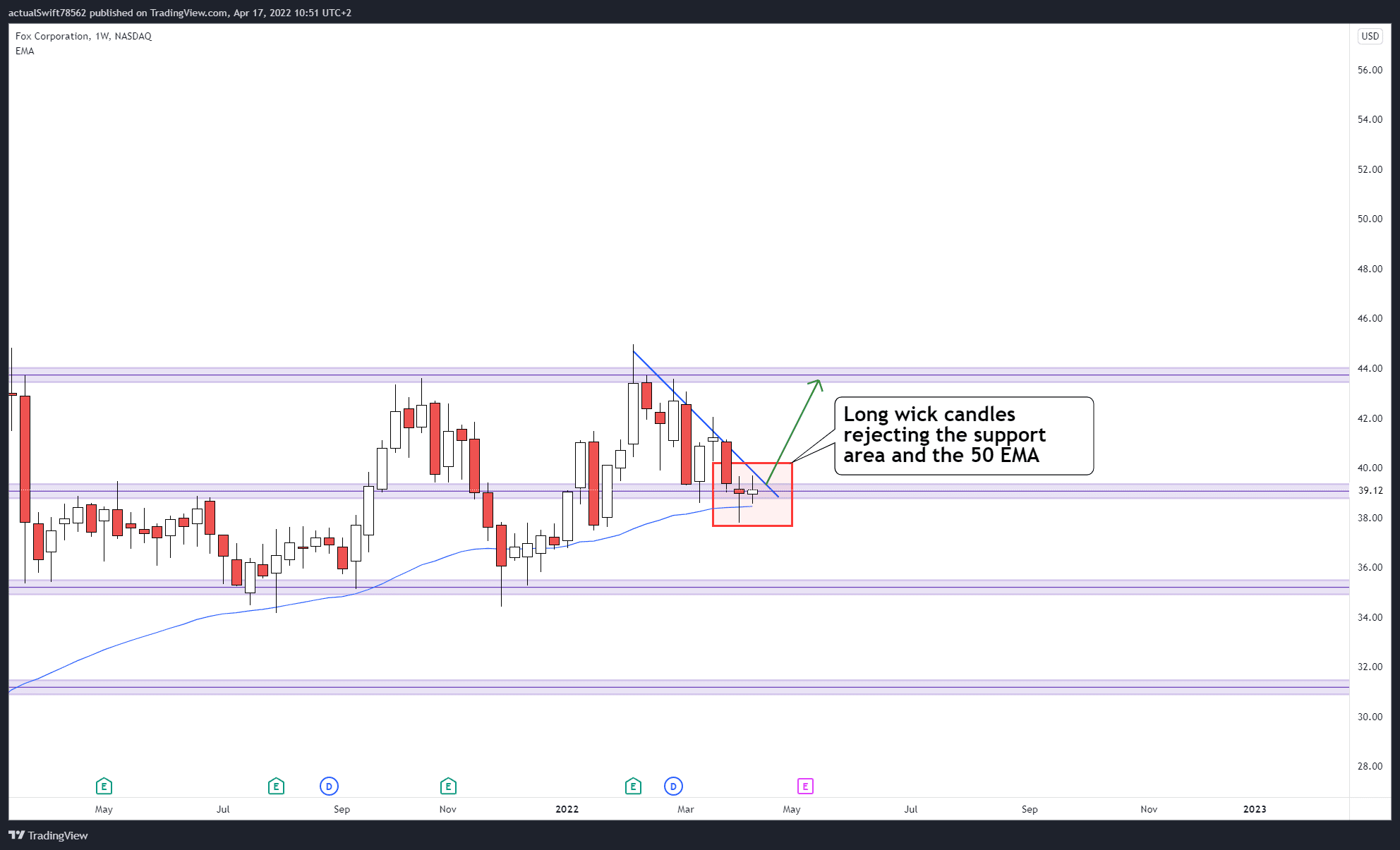

FOXA (Fox Corporation)

We’ll approach these two setups slightly differently by using multiple timeframes.

Here is how:

We spotted this setup all the way on the weekly timeframe, but since that time frame is so large, waiting for a weekly candle close for an entry would just result in us missing a lot of potential profit. That’s why we’ll be looking for an early entry on the 4h timeframe.

First of all, on the weekly timeframe we saw the price make a move down, back into a support area. There we saw long wick rejection candles rejecting both the support area and the 50 EMA. That confirmed our potential setup.

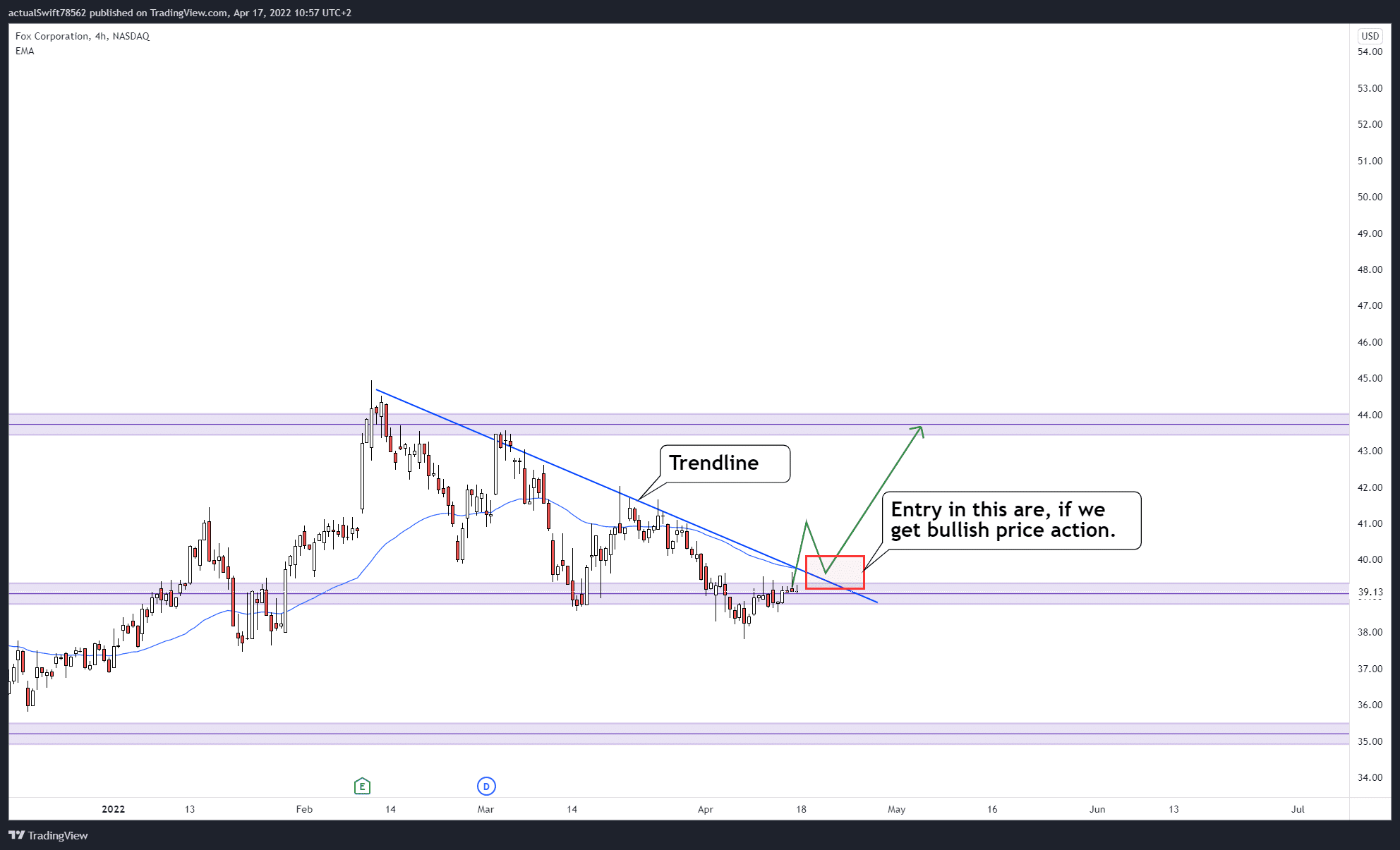

When we go down to the 4h timeframe, we can see that we are able to draw a beautiful trendline throughout the entire move down. And that trendline is the key for our early entry. Once the price breaks and closes above that trendline, our entry will be confirmed.

You can either enter right as the price breaks and closes above the trendline, or you can wait for a pullback.

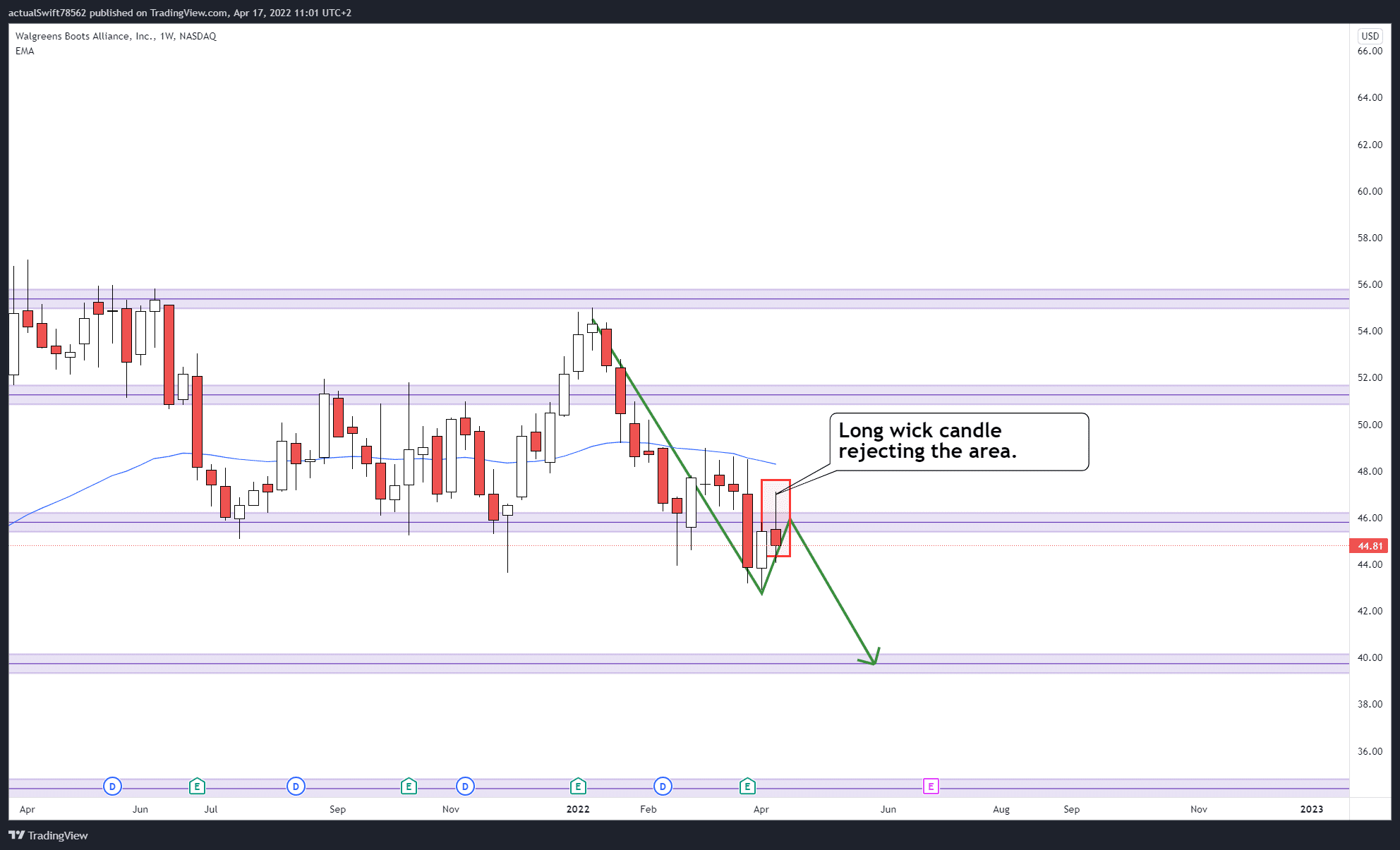

WBA (Walgreens Boots Alliance)

Our next setup is very similar to the previous one, in terms of entry.

We also spotted this setup on the weekly. We had a break of the support area, and a pullback back into the area, with a long wick candle rejecting the area.

Down on the 4h timeframe, we are again able to draw a trendline on the pullback.

Just like with the previous setup. We’ll be looking for the price to break and close below that trendline and then look for an entry short.