Hello guys, welcome to this weeks market analysis where we cover the setups that we are looking at for the upcoming week.

Weekly trade ideas and analysis:

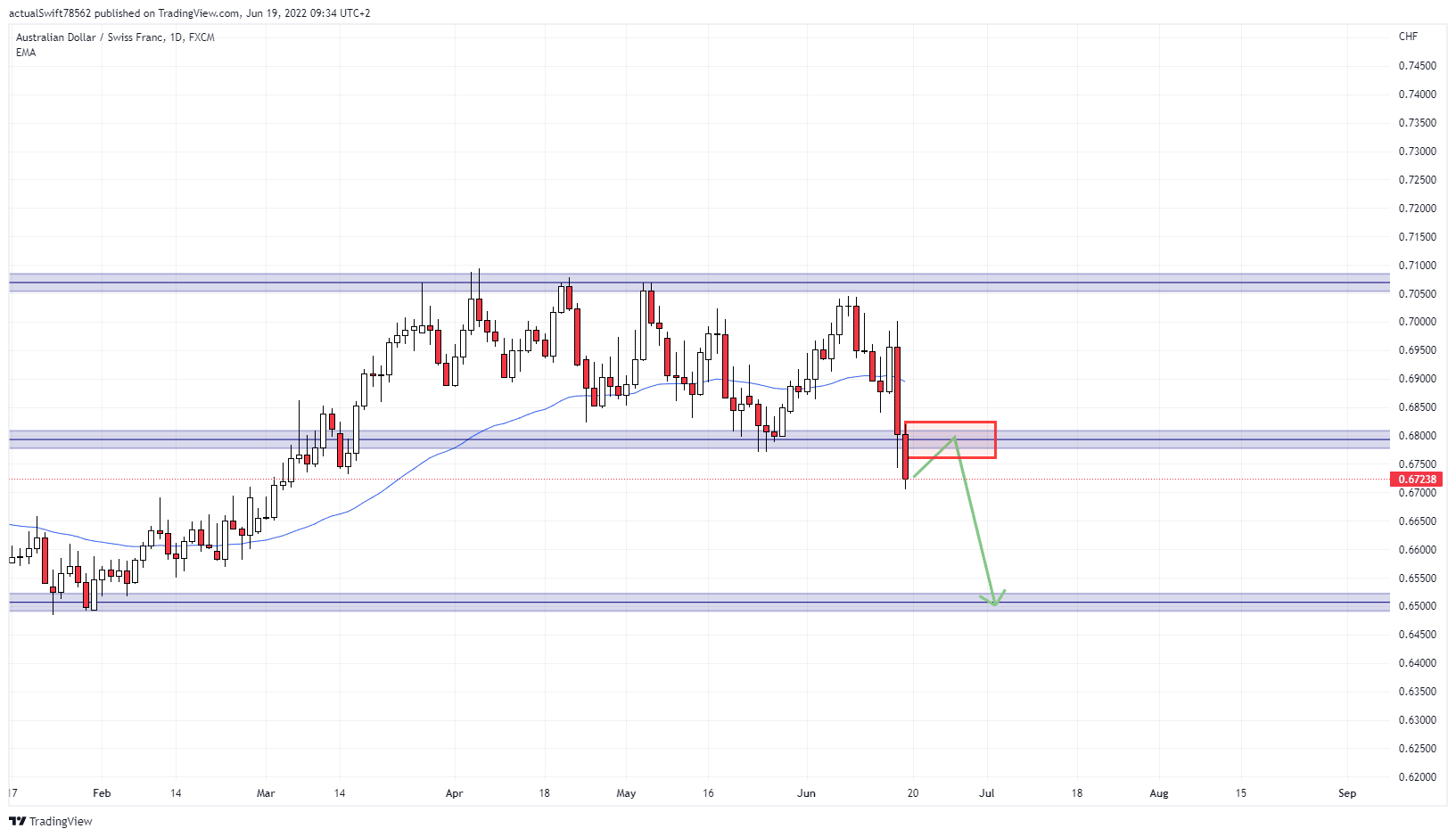

AUD/CHF:

Our first setup of the week is going to be AUD/CHF. We see that the price has been trending sideways for a few months now, but we finally saw a break of the support area last week. We’ll be waiting for a pullback and a potential trade short if we get bearish price action.

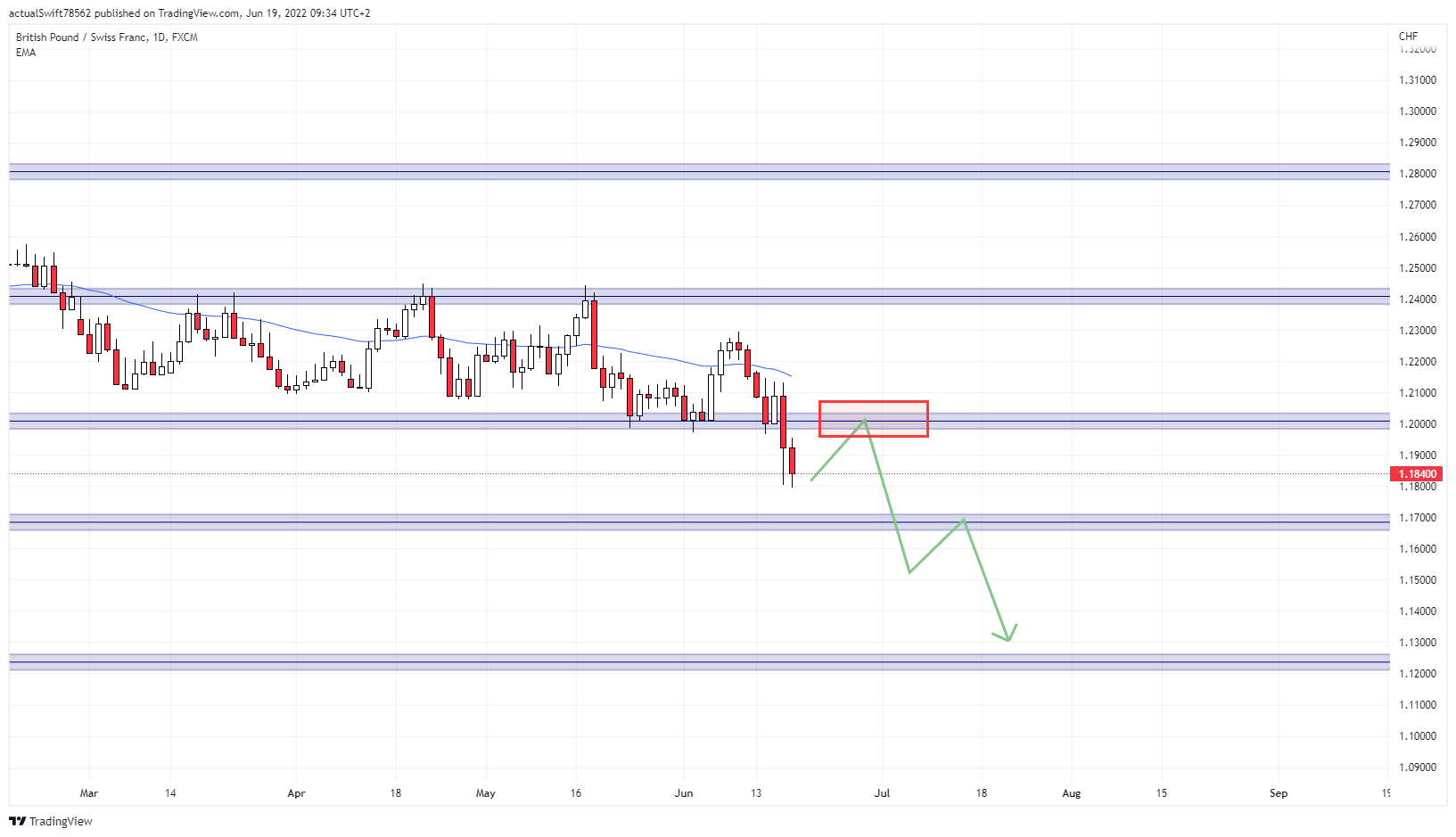

GBP/CHF:

This being another CHF pair we are seeing a similar situation here. The price finally broke the support area after trending sideways and now we are waiting for a pullback and a potential trade short.

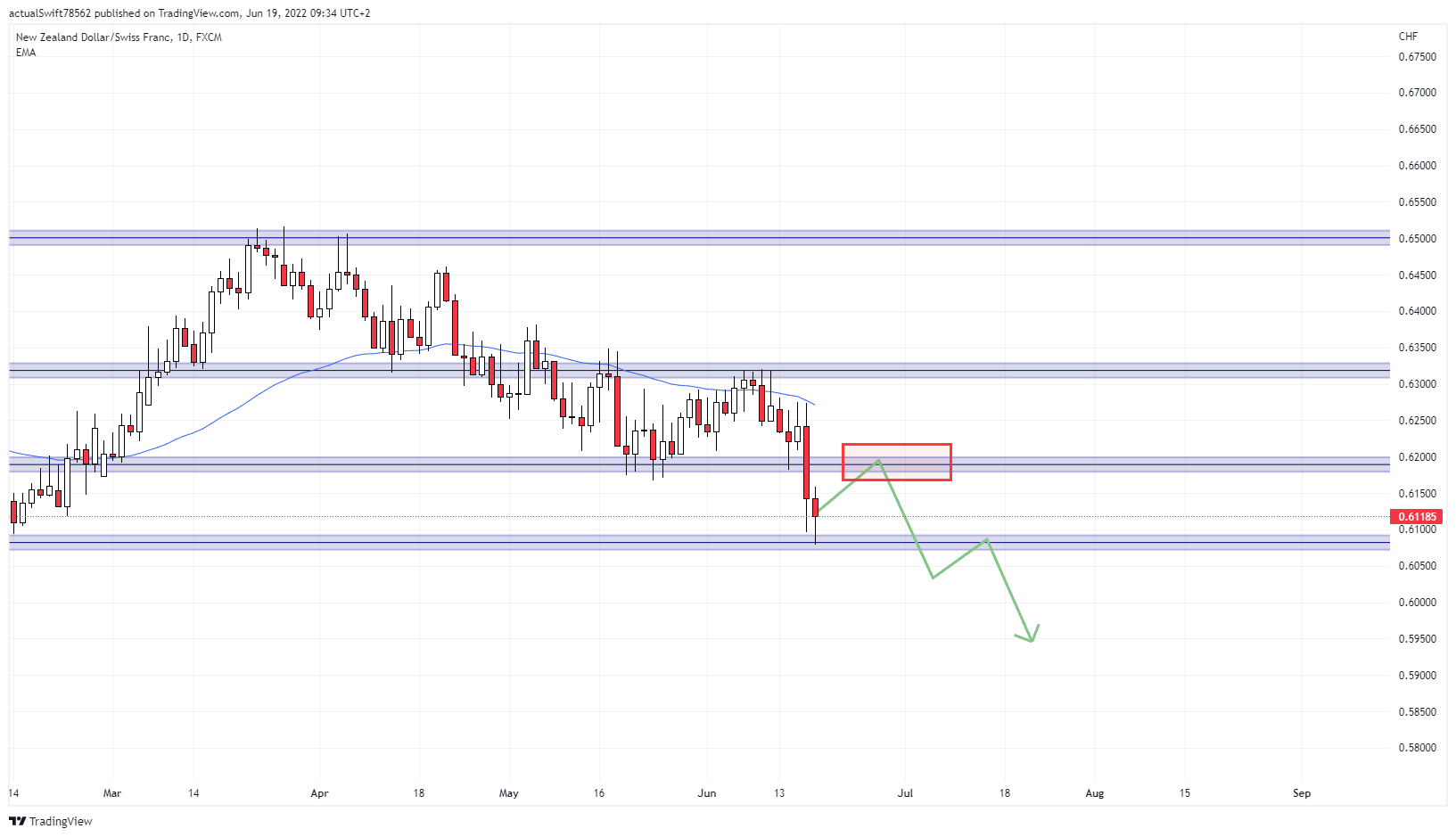

NZD/CHF:

Our last setup is also a CHF pair. Again we are waiting for a pullback and a potential trade short after the price finally broke the support area.

As you have noticed these are all CHF pairs with almost identical price action, we recommend that you either enter only one pair (Preferably the one with the best PA) or you spread your risk amongst all three of them.