Hello guys, welcome to this weeks market analysis where we cover the setups that we are looking at for the upcoming week.

Weekly trade ideas and analysis:

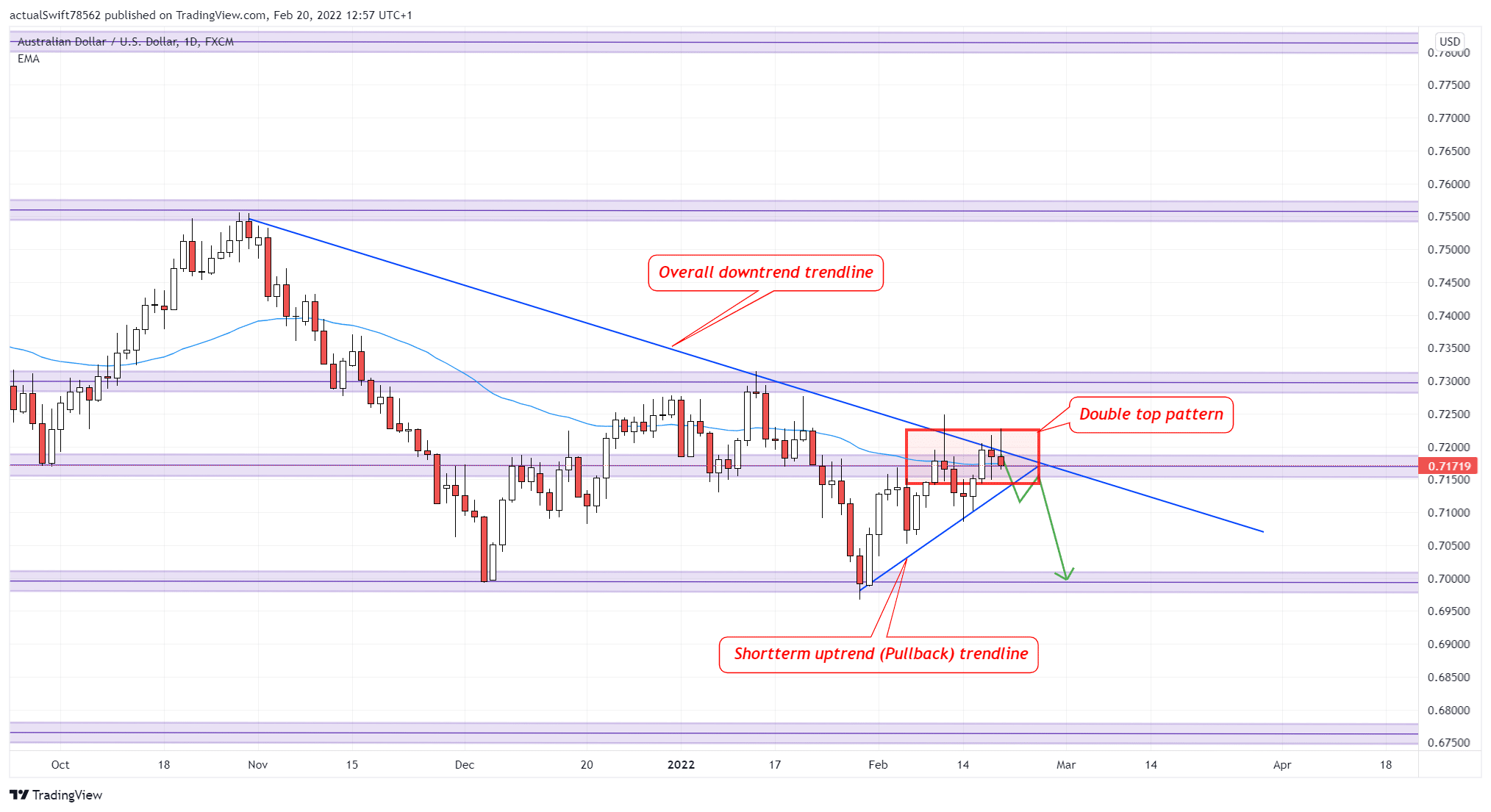

AUD/USD:

The first setup of the week is going to be AUD/USD short trade.

We see that the price here is overall in a downtrend. It has recently made a pullback back into a strong S/R area that also aligns with the downtrend trend line and the 50 EMA. The price also made a double top pattern with long wicks rejecting the area. This gives us a great opportunity for a short trade.

We also drew in a short-term uptrend (pullback) trend line. We will look for entries after the price breaks that trend line and confirms that the pullback is over.

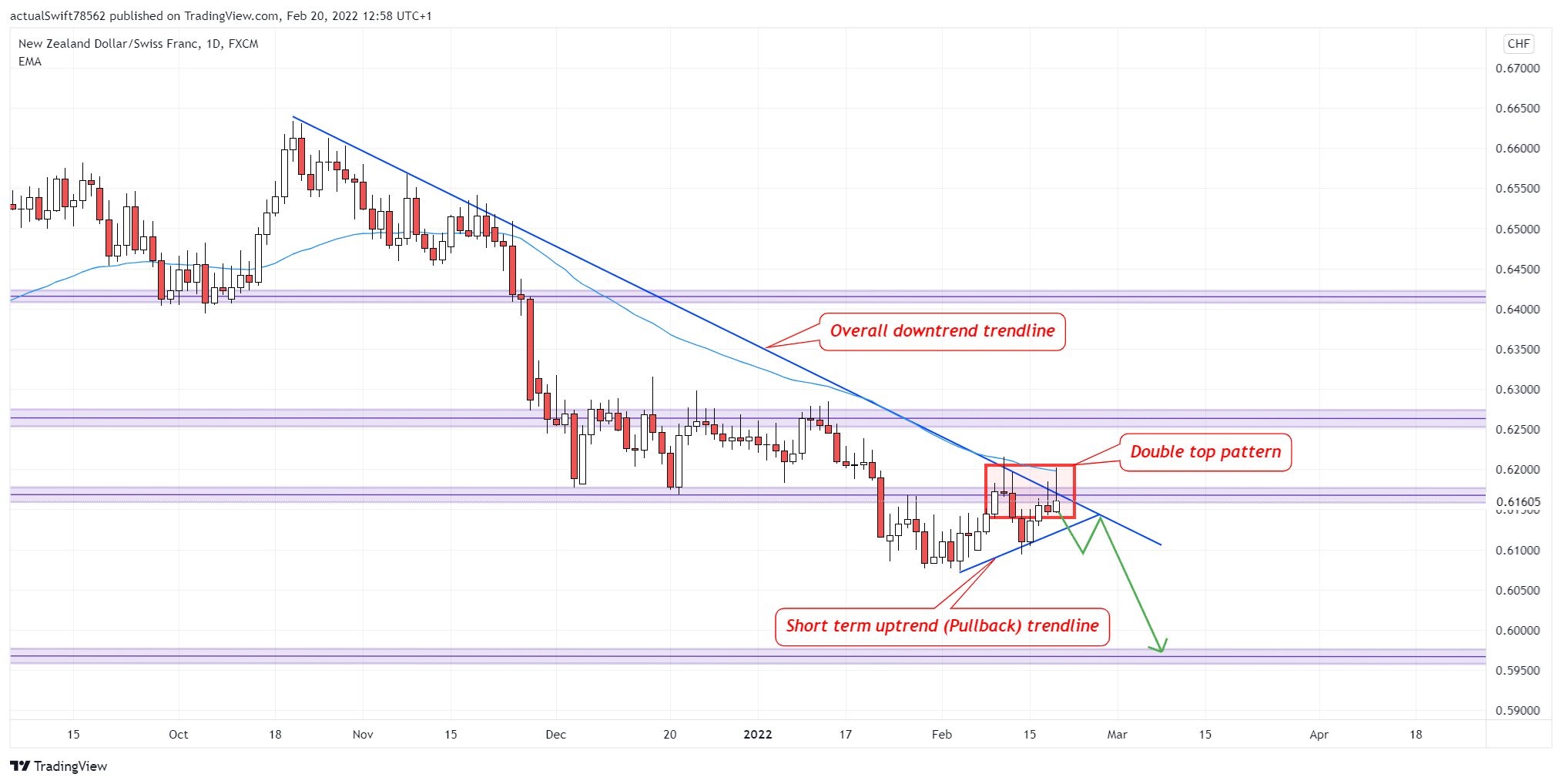

NZD/CHF:

Similarly to our previous pair, the price is overall in a downtrend. It made a pullback back into the downtrend trend line, which also aligns with a S/R area and the 50 EMA. We also see a double top pattern with long wicks rejecting the area, which makes for a great short trade opportunity.

Our entry will be the same as for the previous pair. If we get a break of the short-term uptrend (pullback) trend line, we will look for entries short.

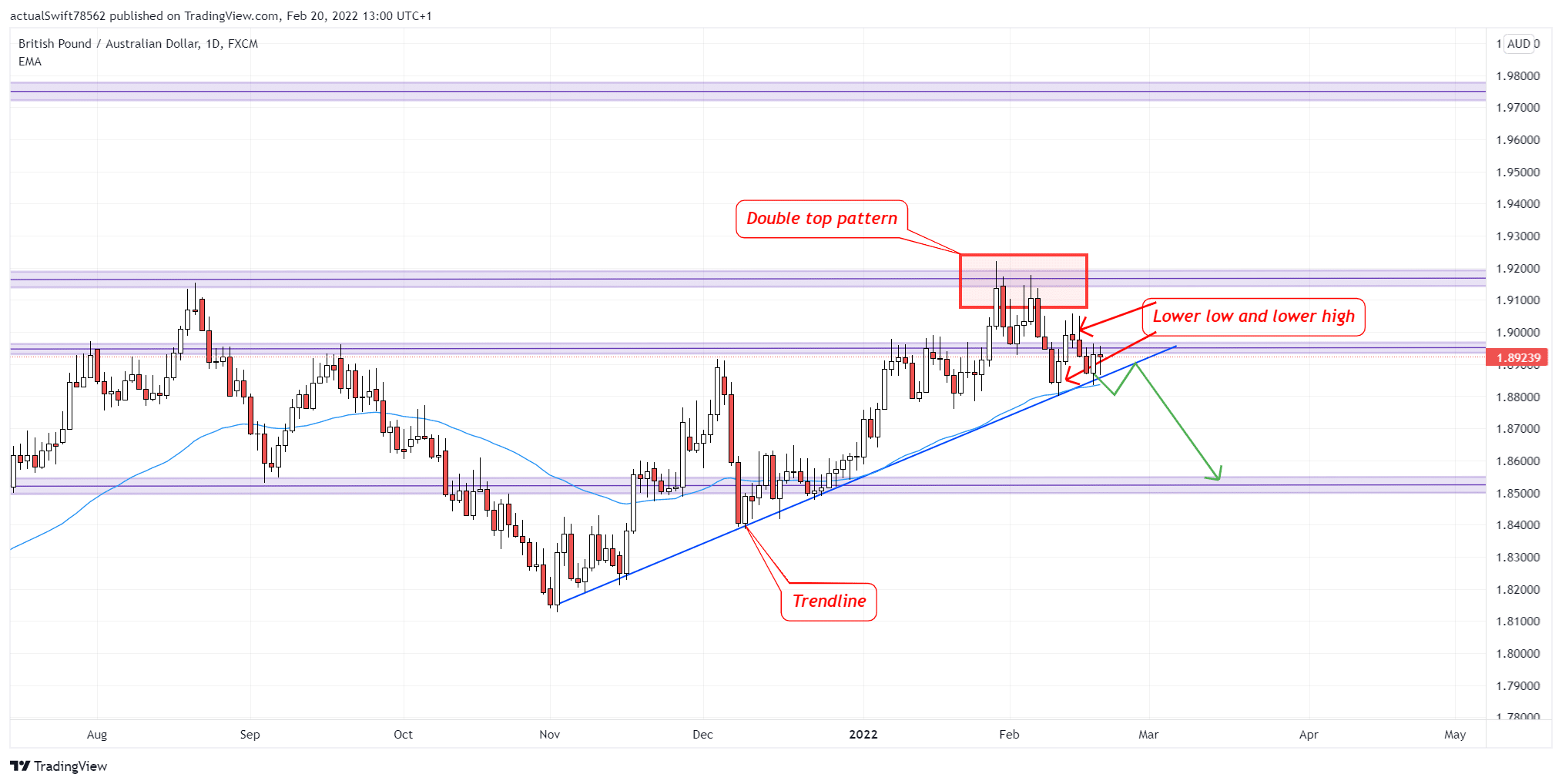

GBP/AUD:

Our last setup is slightly riskier since we would be a trading countertrend. But we are getting good signs that the price might turn around.

If we look at the trend structure, we see that the price was trending up. But recently it has made a double top pattern, which means that bulls could no longer push the price higher, which means that bears are stepping into the market.

After that double top pattern, a change in the trend structure happened. From an uptrend with higher highs and higher lows, we got a lower low and a lower high.

All of those are very bearish signs.

We have also drawn in a trend line. If we get a break and a close below that trend line, we will start looking for entries short.