Hello guys, welcome to this weeks market analysis where we cover the setups that we are looking at for the upcoming week.

Weekly trade ideas and analysis:

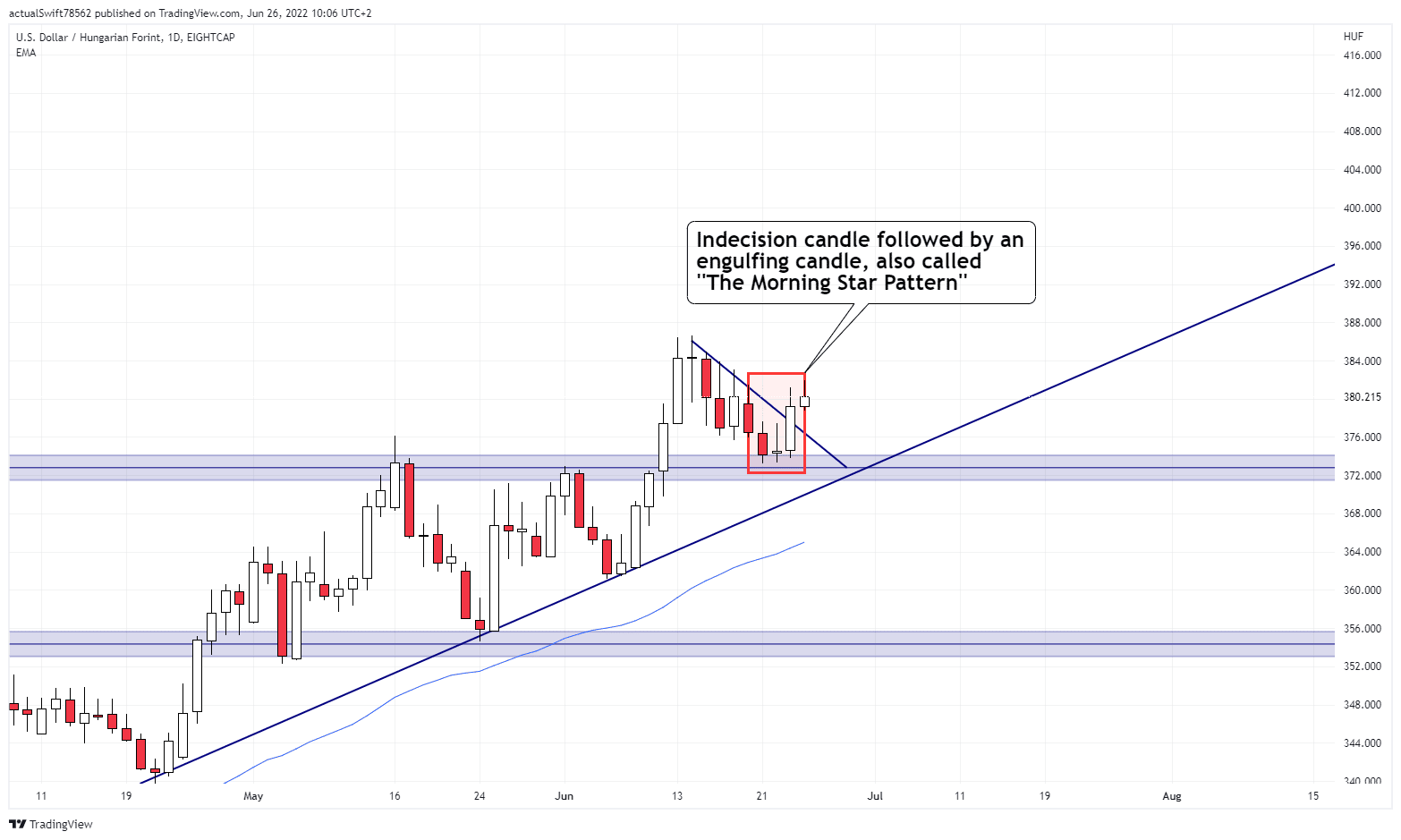

USD/HUF:

Our first setup of the week is a potential trade long. The price has recently broken a strong resistance area and made a pullback back into it. The area also perfectly aligns with the 50% FIB area.

A setup formed when we got an indecision candle followed by an engulfing candle on the daily.

We will look for an entry in the 4h timeframe after we get a break and a close above the trendline that we placed.

Daily:

4h:

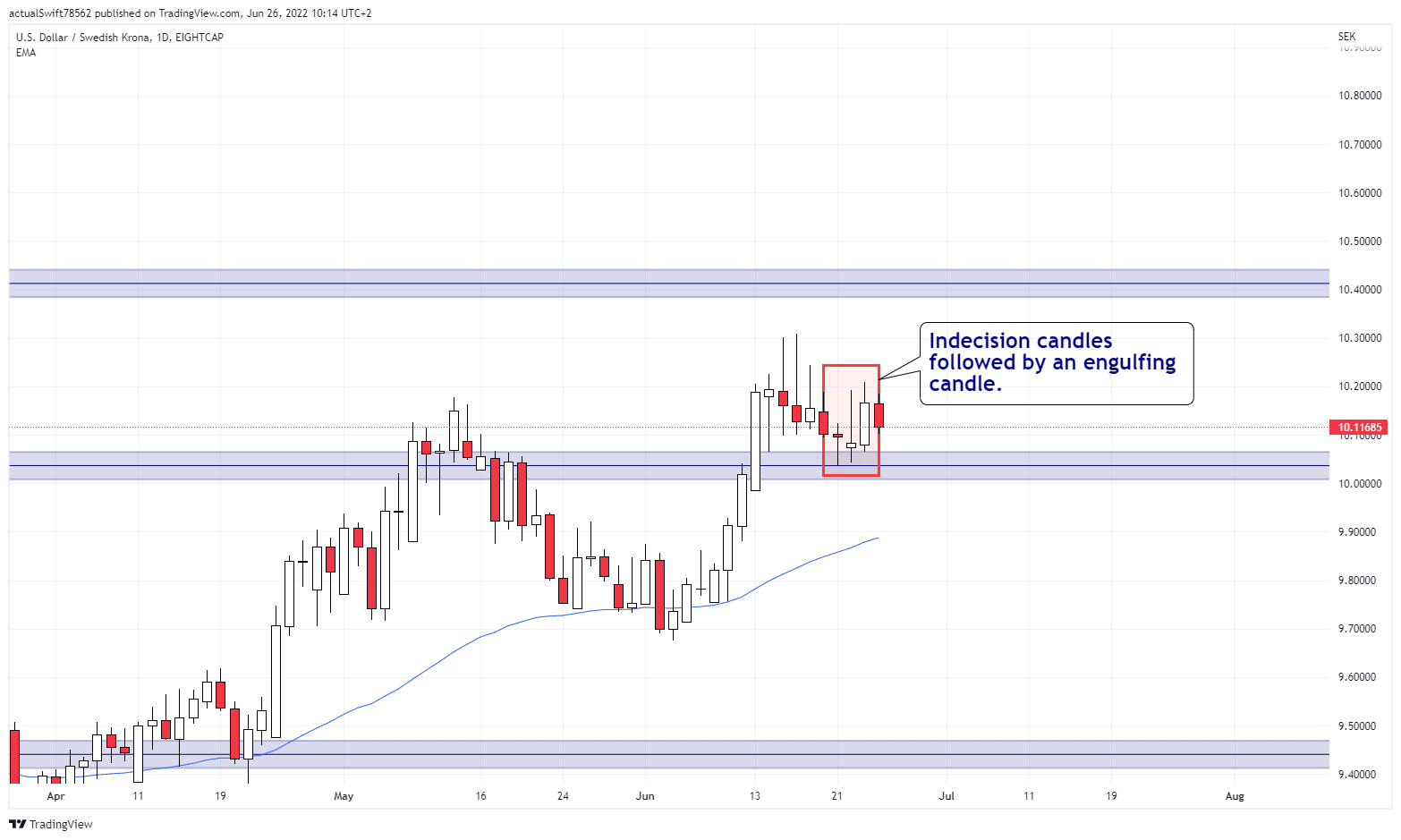

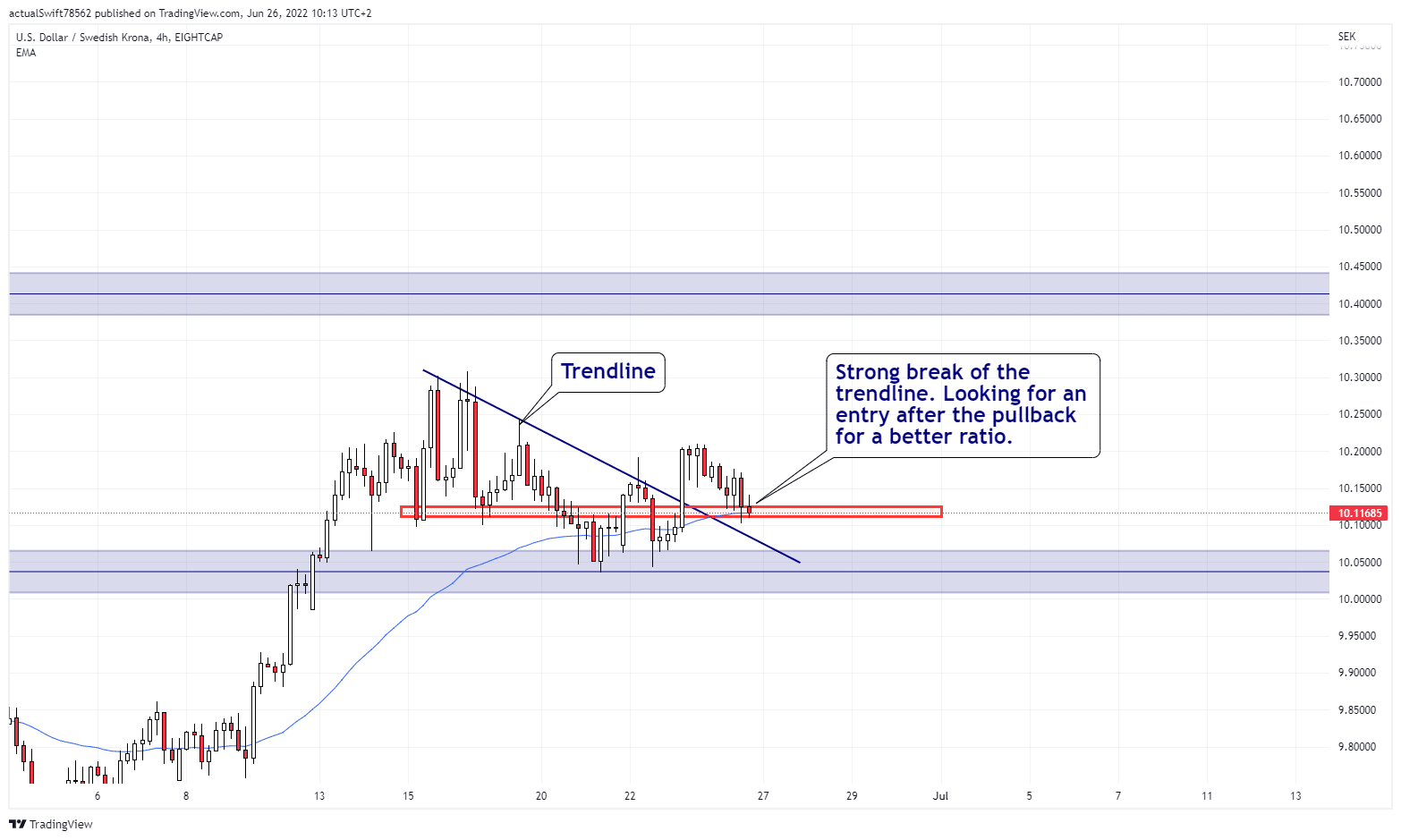

USD/SEK:

USD/SEK is another potential trade long. We got a break of the resistance area followed by a pullback. At the now support area an indecision candle formed followed by an engulfing candle.

We’ll again be looking for an entry on the 4h time frame after a break of the trendline.

Daily:

4h:

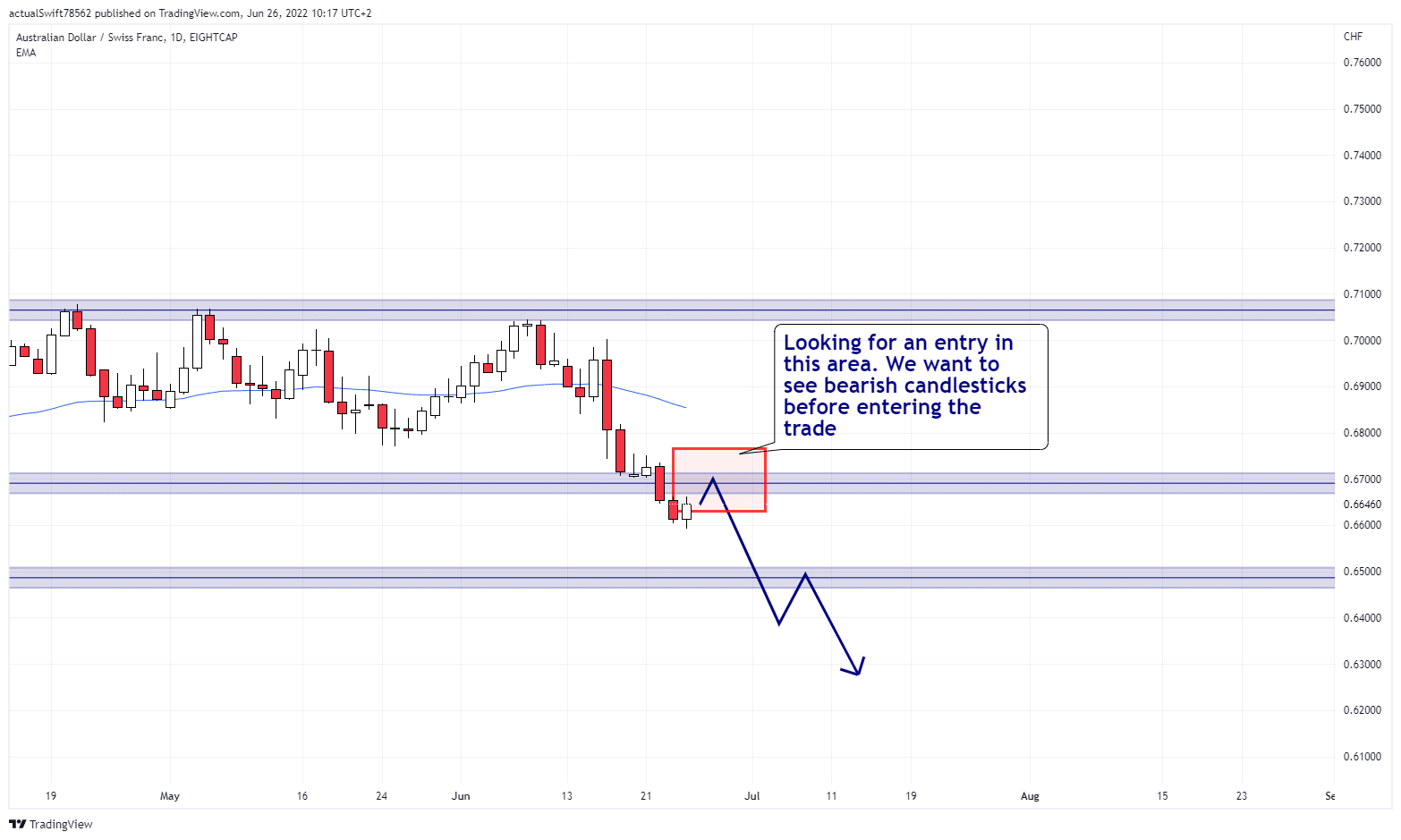

AUD/CHF:

After the break of the support area, we are looking for a pullback and an entry for a potential continuation trade short. We of course want to see bearish candlestick PA before entering short.

Daily:

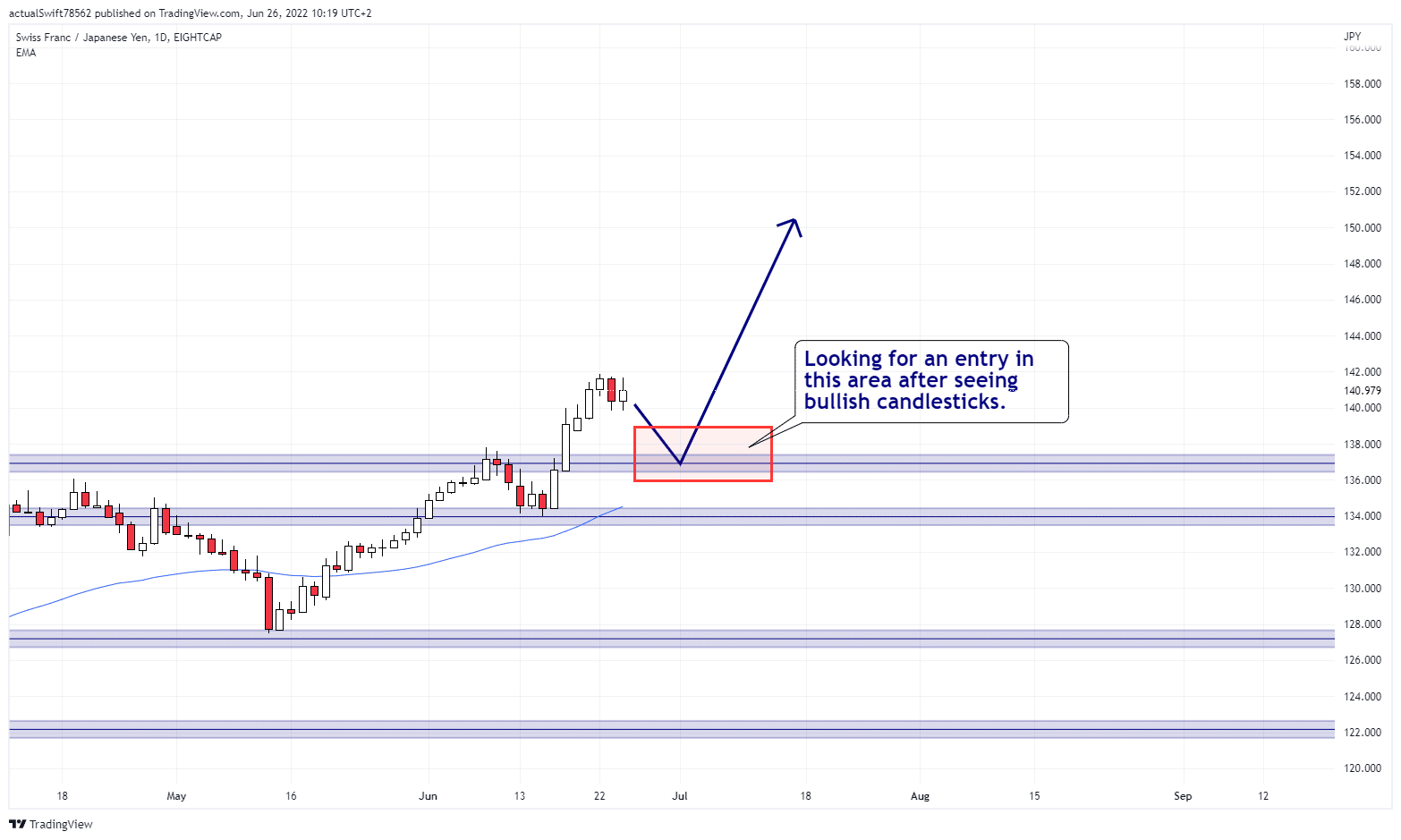

CHF/JPY:

After the break of the resistance area, we are now waiting for a pullback back into the now support area. If we get bullish candlesticks forming on the area we’ll look for a potential trade long. Note that this setup will most likely form next week.

Daily:

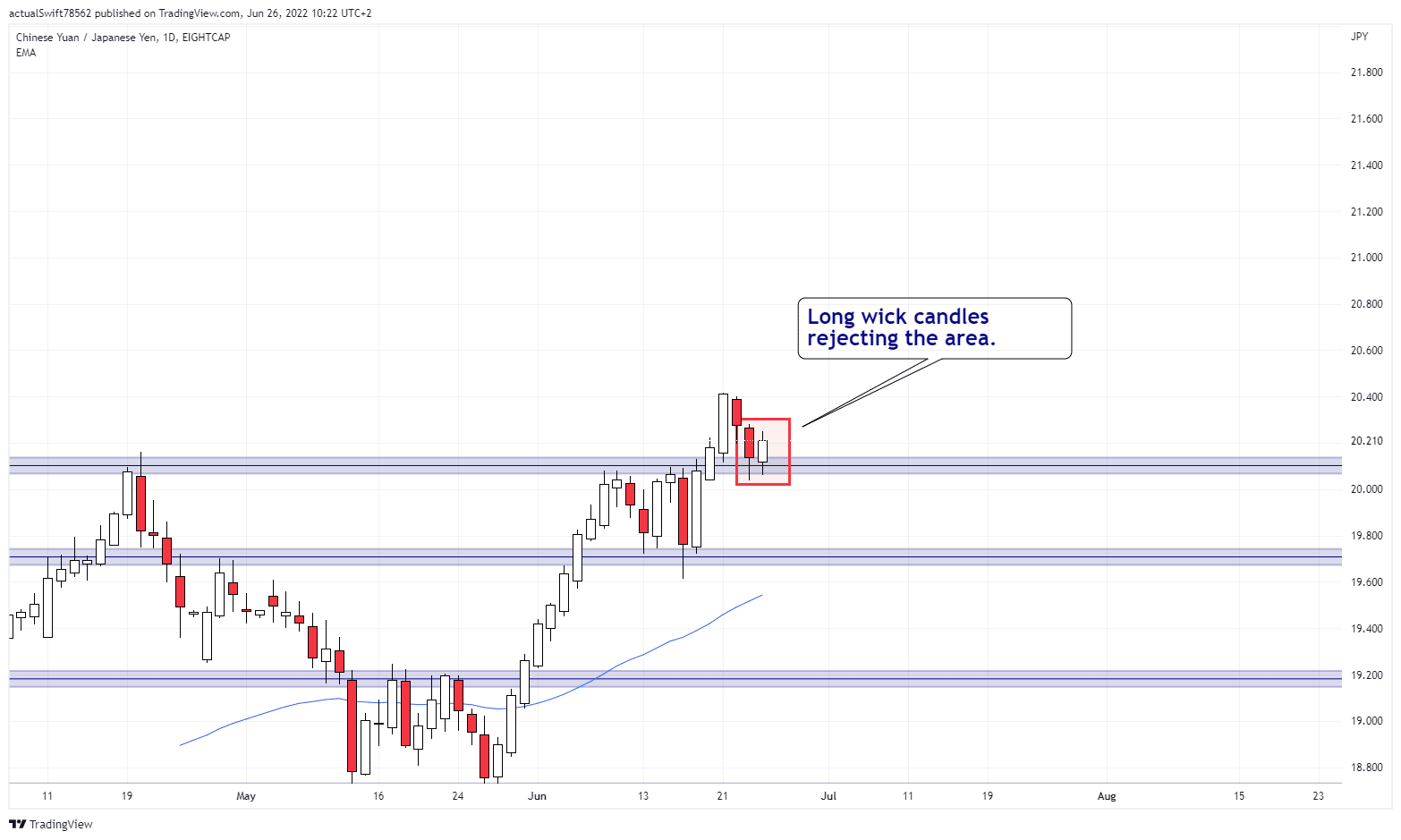

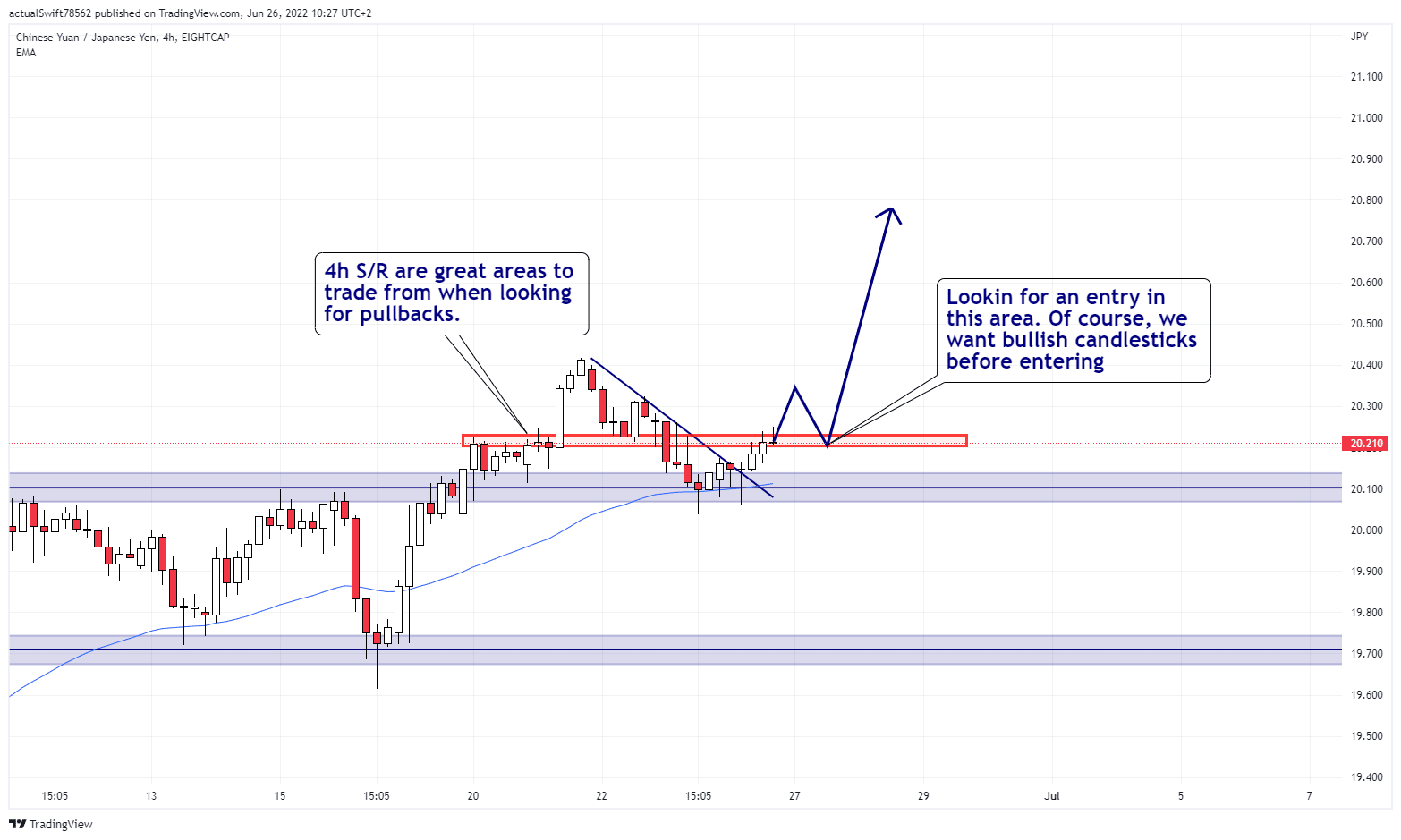

CNH/JPY:

Another potential trade long after the break of resistance area and a pullback. The area aligns with the 50% FIB area and we can see candlesticks with long wicks rejecting the area.

We’ll look for an entry on the 4h timeframe after the break of the trendline that we placed.

When trading a break of the trendline we want to see a strong momentum candle break it. In this scenario we don’t have that, that’s why we didn’t enter yet. In this case we’ll wait for a pullback in combination with bullish candlestick PA before entering.

Daily:

4h:

GBP/CHF:

After the price broke the support area this became a potential trade short. We want to see a pullback back into the now resistance area.

Daily:

NZD/CHF:

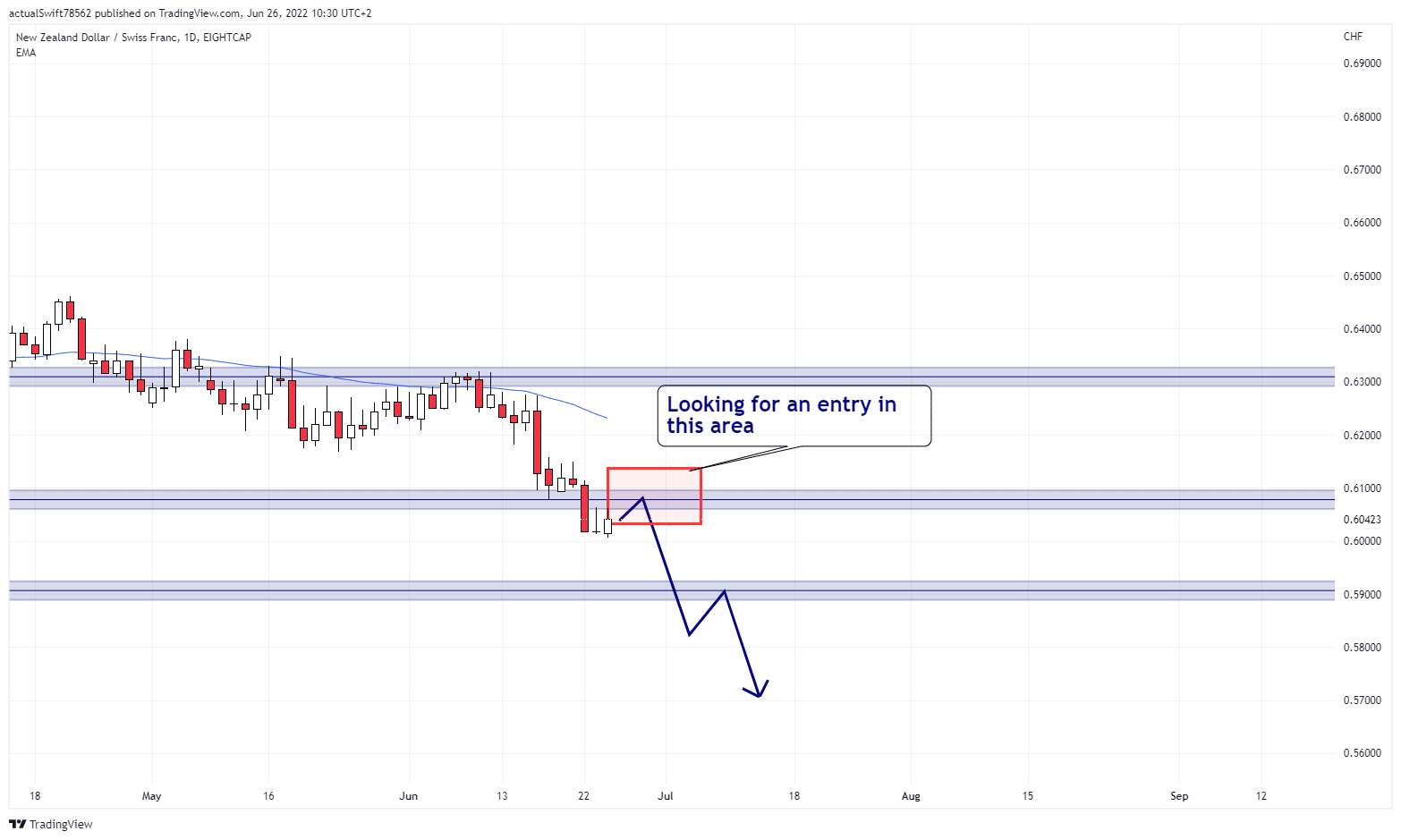

Another potential trade short after the break of the support area. We’ll look for an entry after the pullback.

Daily:

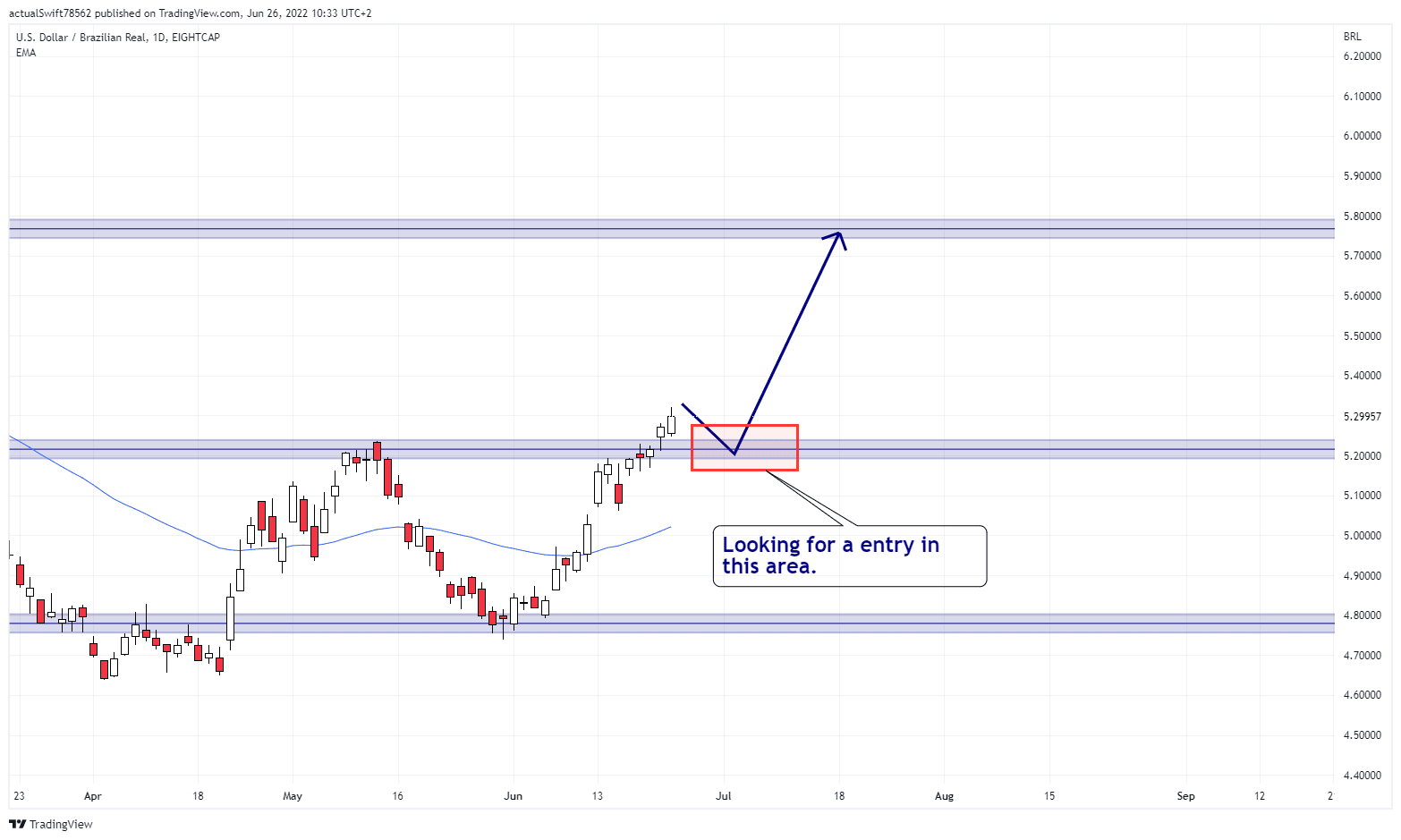

USD/BRL:

This is a potential trade long after a break of the resistance area. If we get a pullback in combination with bullish PA we’ll look for an entry.

Daily:

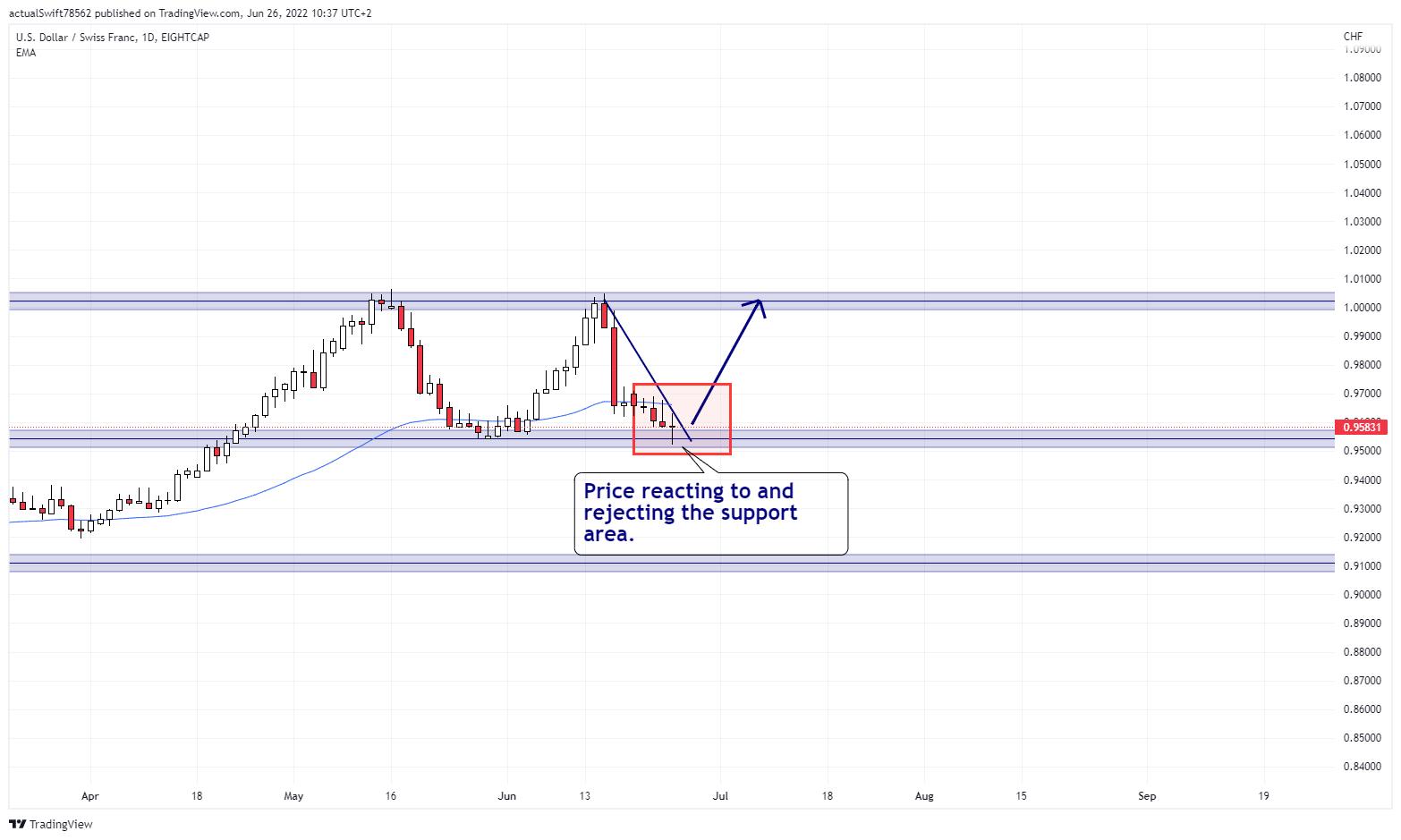

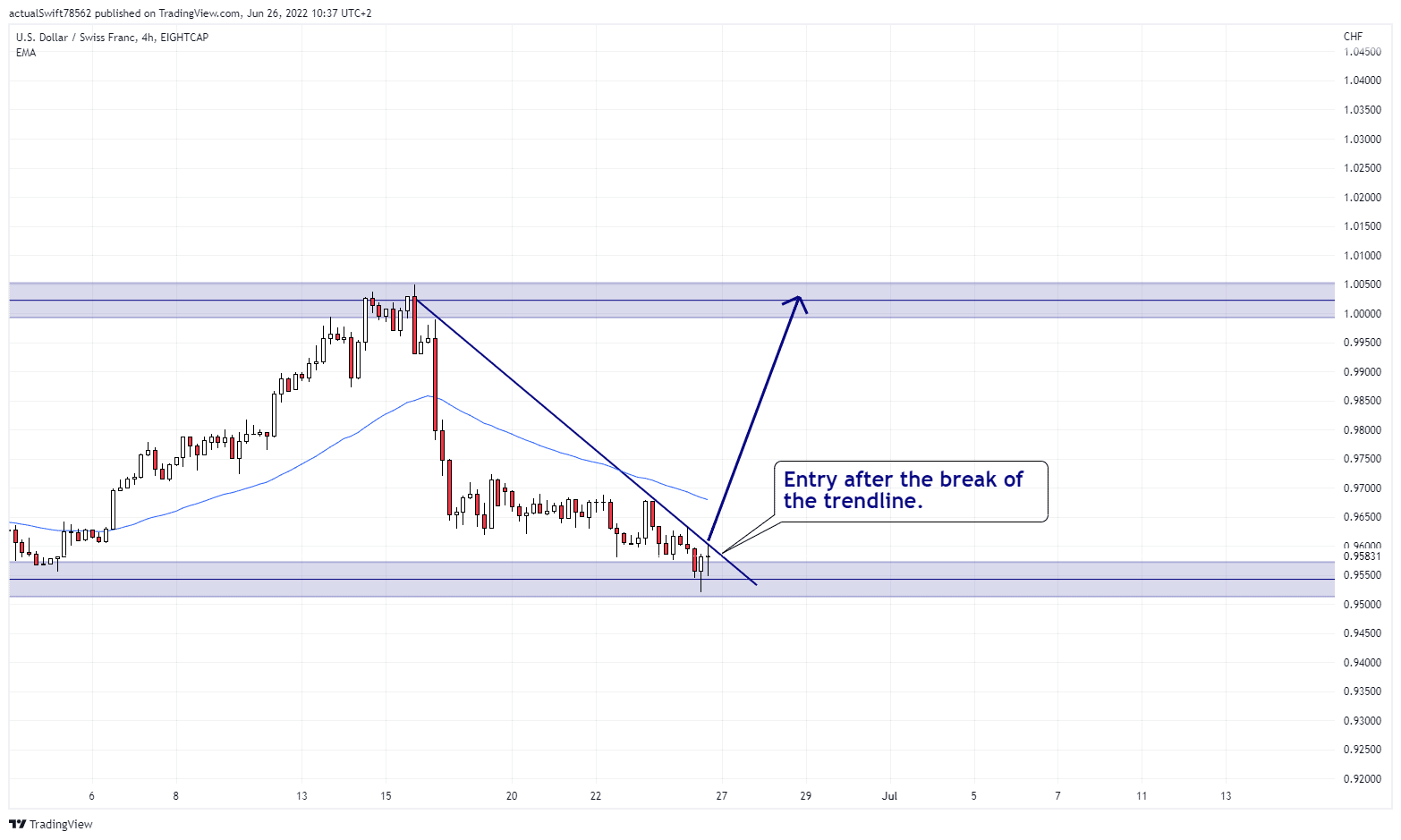

USD/CHF:

This is a range trade long. We see the price rejecting the support area which made this a potential setup.

After placing a trendline we’re now waiting for a break of that trendline on the 4h timeframe and an entry long.

Daily:

4h: