Hello guys, welcome to this week’s market analysis where we cover the setups that we are looking at for the upcoming week.

Weekly trade ideas and analysis:

GBP/AUD:

Our first pair is actually an active trade we are in and I just want to go through how we’ll play out this trade throughout the next week.

We spotted the setup on the daily timeframe and we entered on a 4h pullback. Many people already closed out this trade as it has reached a support area, but we will keep the trade open.

The reason for that is we are not seeing any bullish price action to show that the price might turn around. The daily candles are strong bearish candles and the 4h candles don’t show any bullish presence either.

————————————

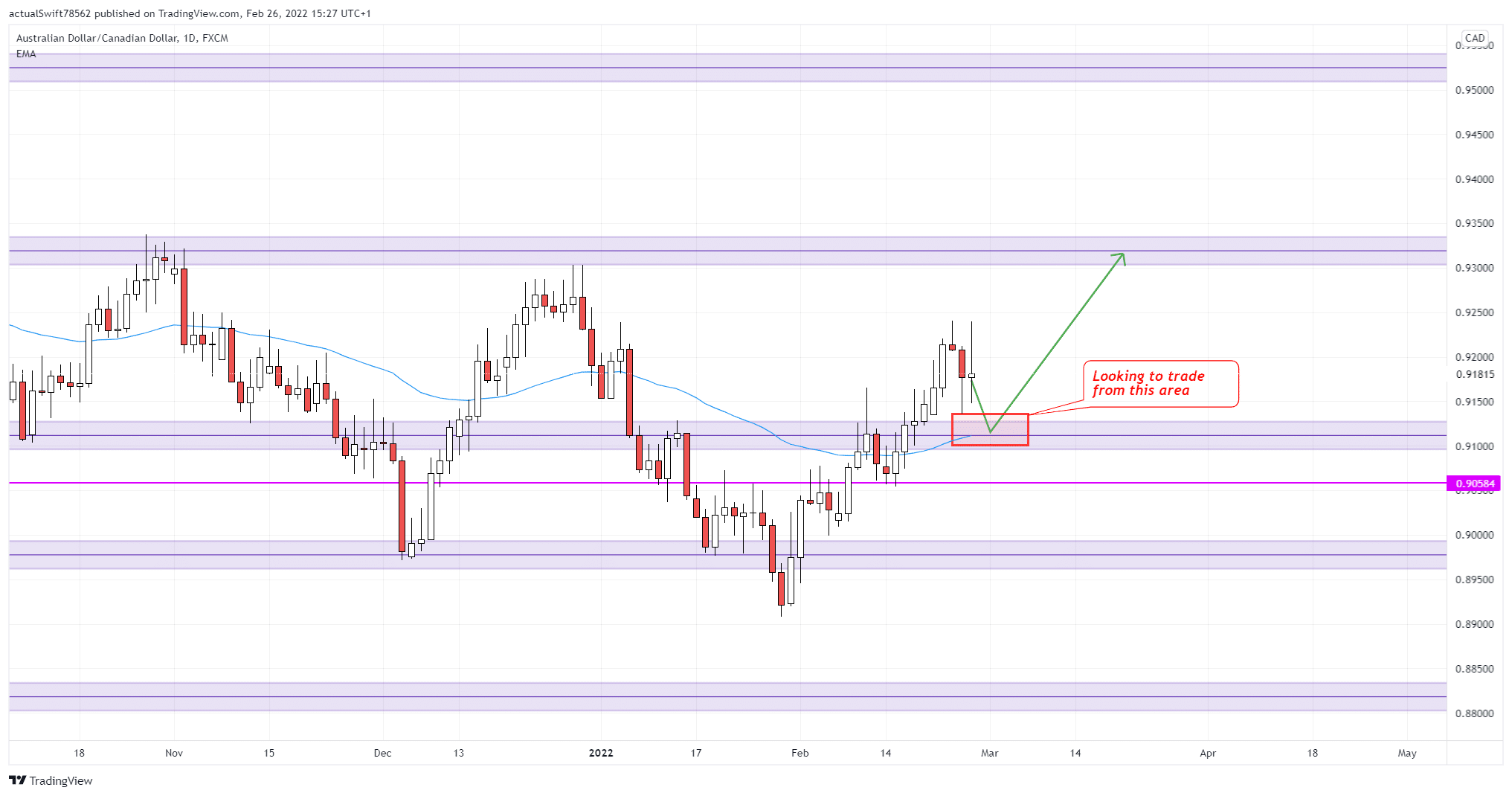

AUD/CAD:

Now let’s move to our actual potential setups. Our first one is AUD/CAD.

We had the price break a resistance area, and now we are waiting for a pullback. If the price reaches all the way to the support area, we will look for an entry long.

Altho the price looks like it could continue back up prematurely, we are still willing to give this setup a try because the resistance area is both the previous higher high and it would align with the 50 EMA as well making for a great area to trade from.

AUD/CHF:

This is another potential trade long. The price finally broke out of a tight range that it was in since December. If we get a pullback back into the support area, we will look for an entry long.

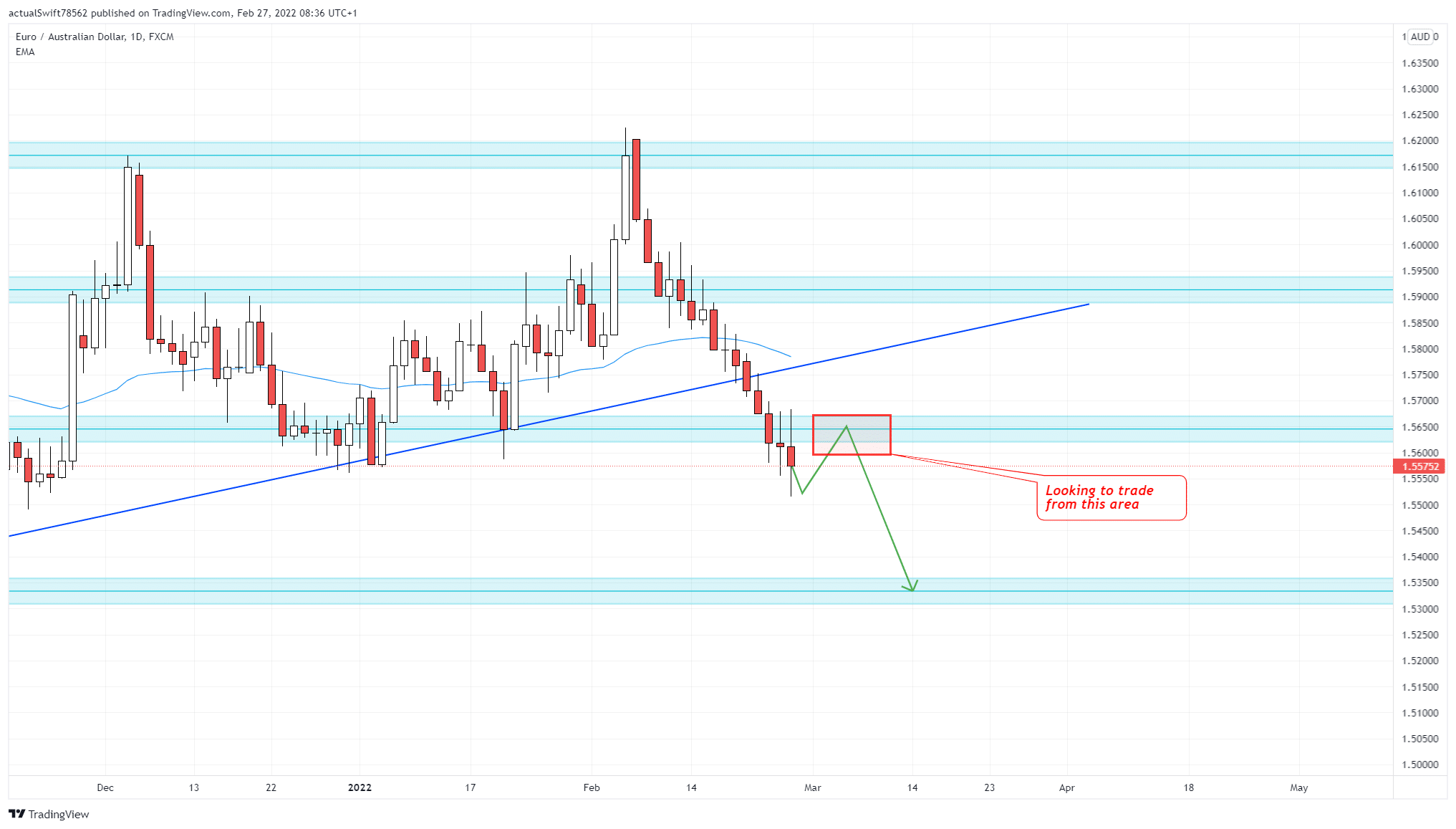

EUR/AUD:

Here the price broke a support area. We are waiting for the price to push slightly lower before making a pullback. If that happens, we will look for a potential trade short from the resistance area.

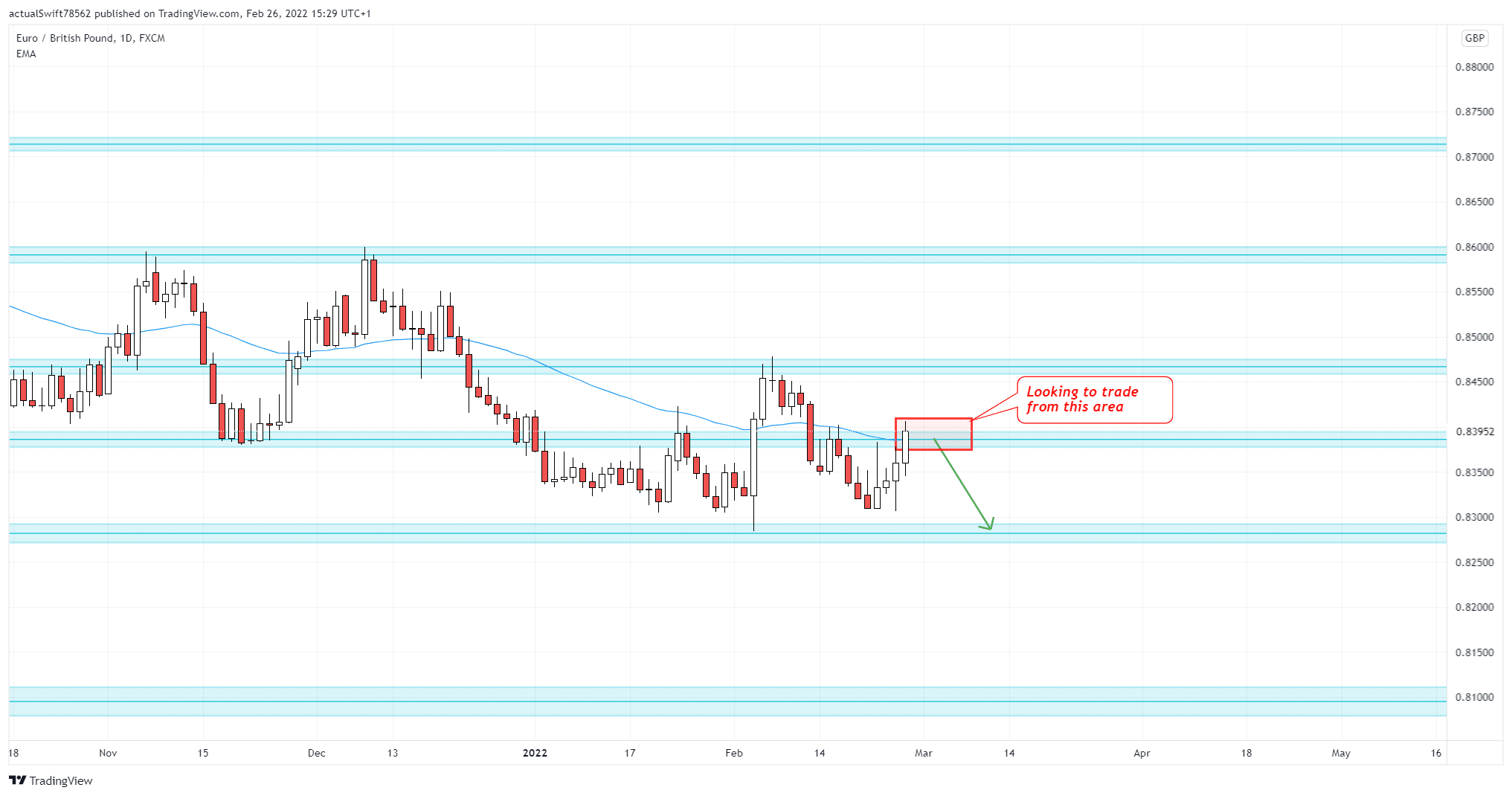

EUR/GBP:

Here we are also looking for a potential trade short. The price has already made a pullback, so now we are waiting for strong bearish price action.

It’s really important that we look for strong price action, as the last candle was a strong bullish momentum candle. We want to make sure that bears are really taking control before entering a trade.

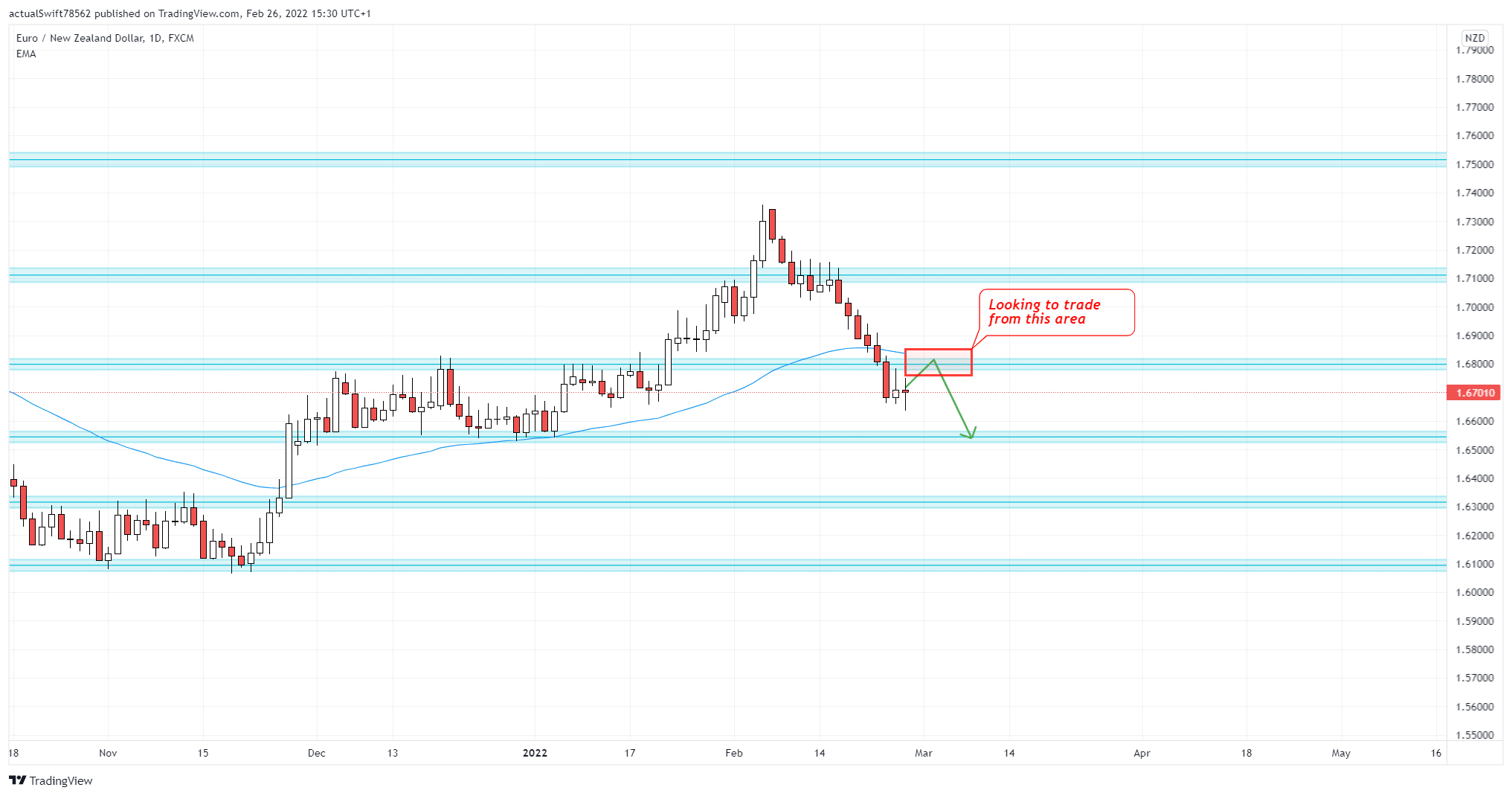

EUR/NZD:

Yet another potential trade short. Just like with the previous setups, we are waiting for the price to make a pullback after it broke the support area last week. If that happens, the price would also align with the 50 EMA making for an even better area to trade from.

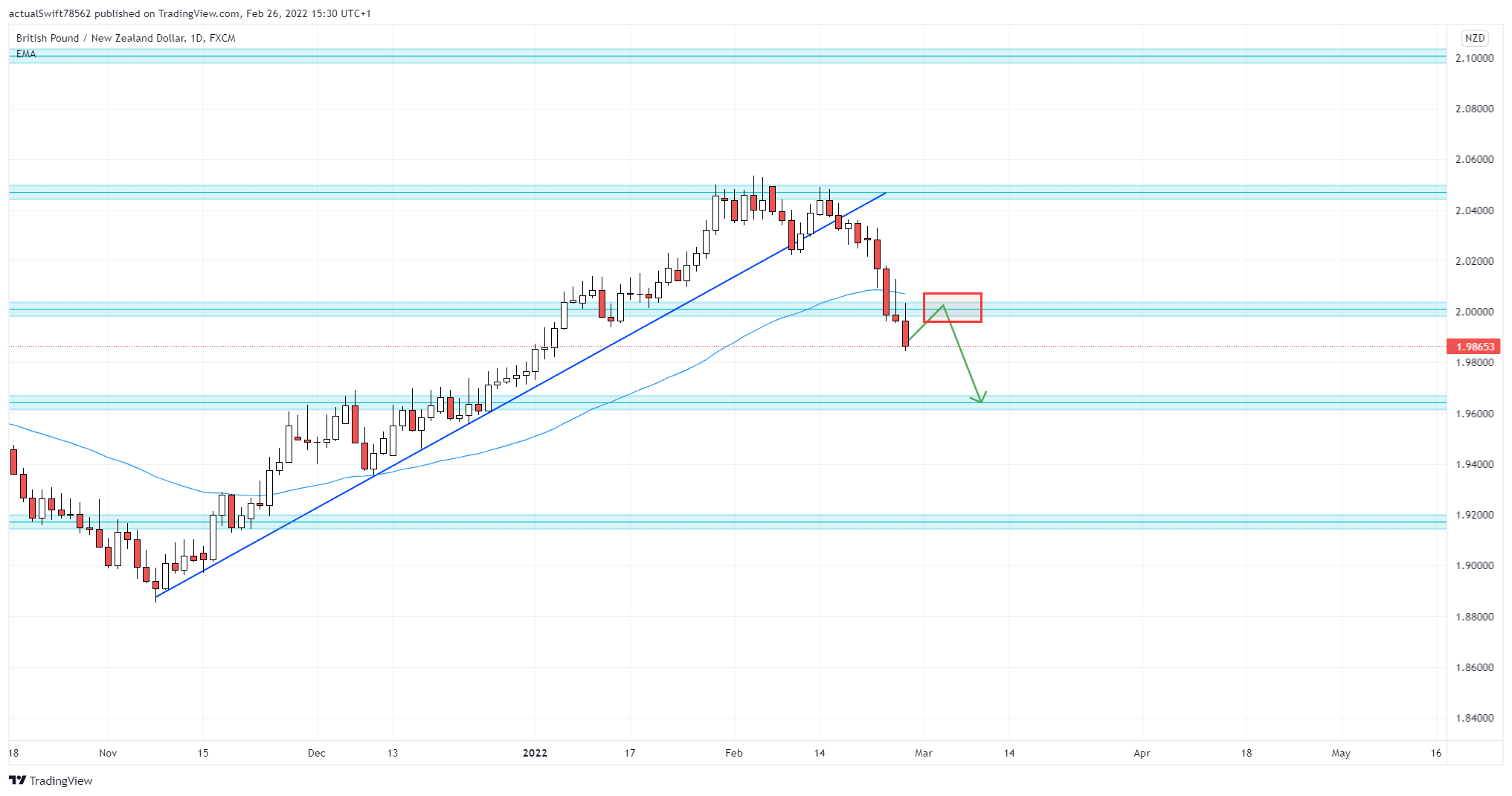

GBP/NZD:

And our last setup of the week is GBP/NZD. Here we are also looking to trade short. The price broke a support area and now we are waiting for a pullback. If that happens, we’ll be looking for a potential trade short.

Note: It is really important that we wait for sufficient price action before entering a trade. Entering without good price action is very risky.

Example: Let’s say we are in an uptrend and we are waiting to enter a trade long. We see a pullback and we want to enter on the pullback.

That pullback means that bears have taken control of the market. That’s why it’s important to wait for price action to show that bears are no longer in control before entering a trade.

Entering a trade just because the price reached an area with no price action is extremely risky!