Hello guys, welcome to this weeks market analysis where we cover the setups that we are looking at for the upcoming week.

Weekly trade ideas and analysis:

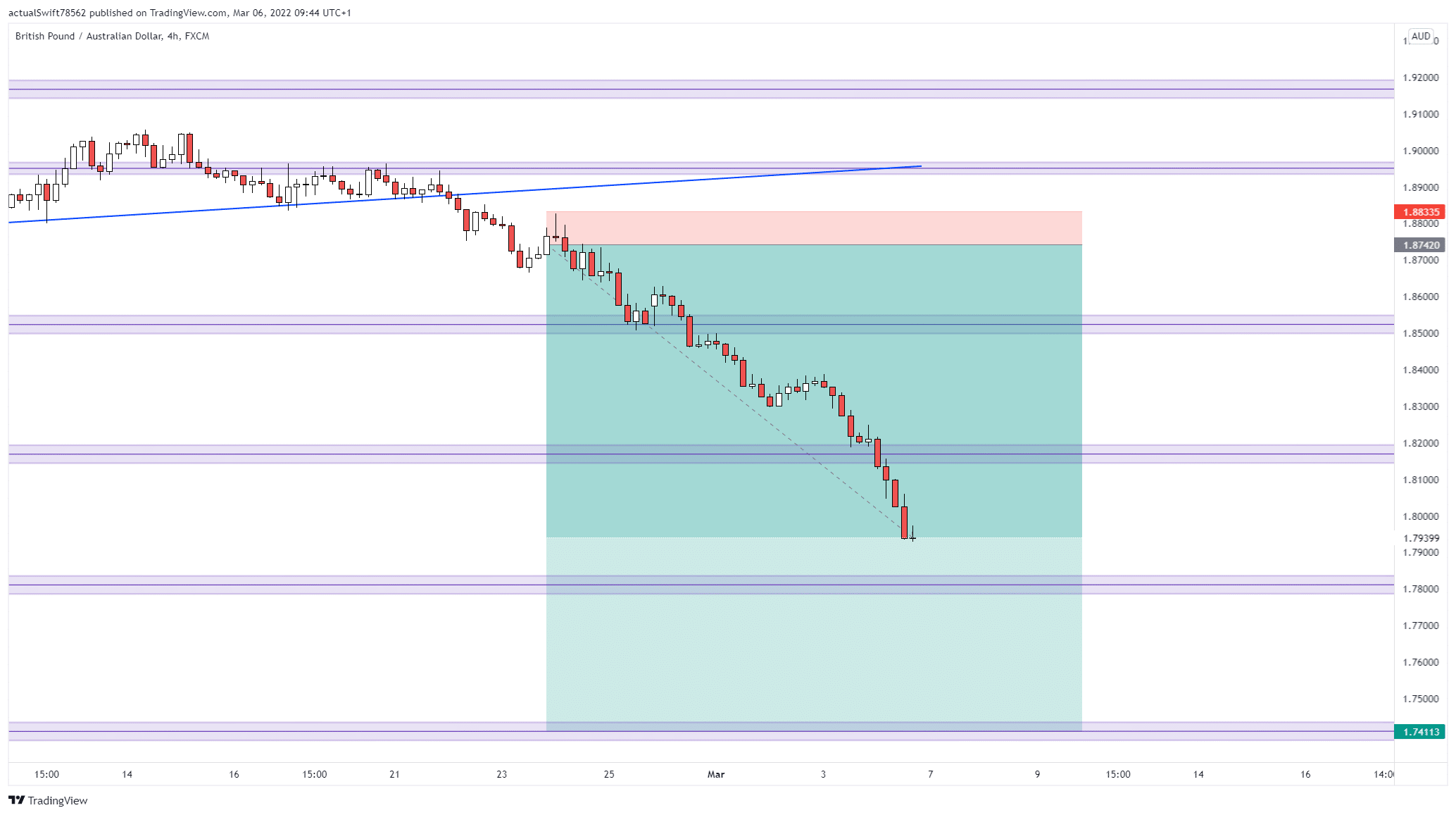

GBP/AUD Active Trade:

We’ll start off this analysis with an active trade. This trade turned into a big winner as it is currently at 8:1.

Just like last week, we will not close out this trade yet as we are seeing no bullish price action.

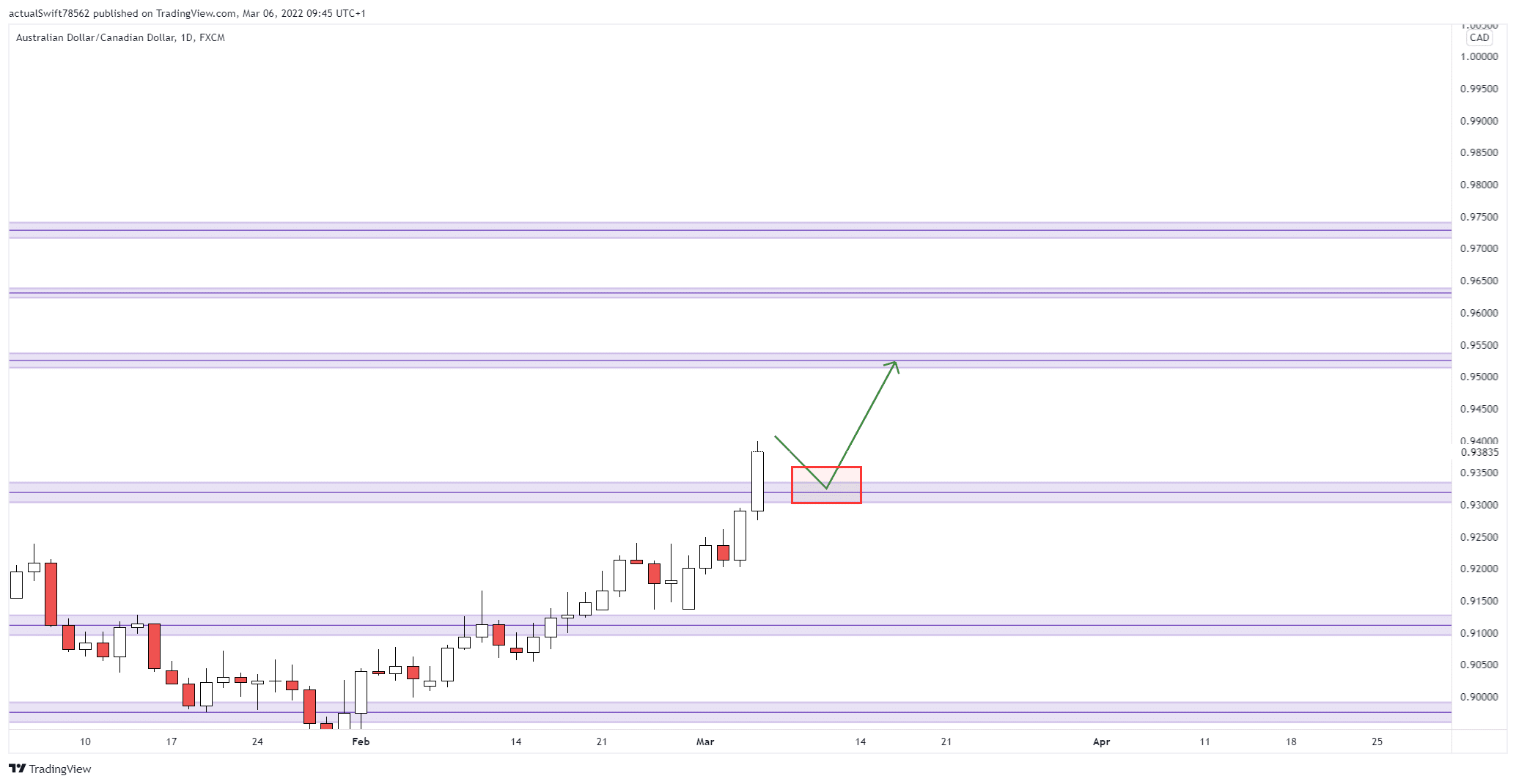

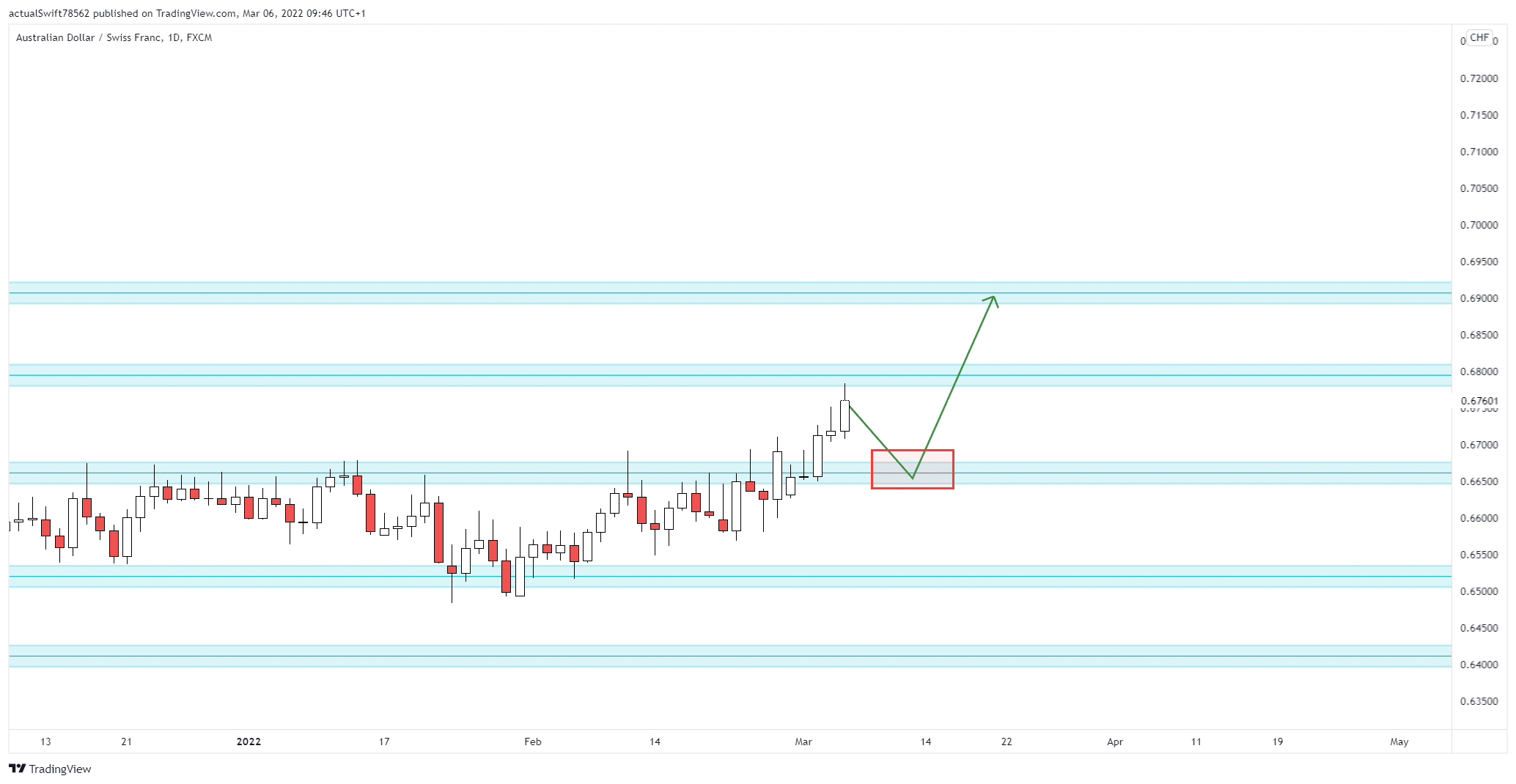

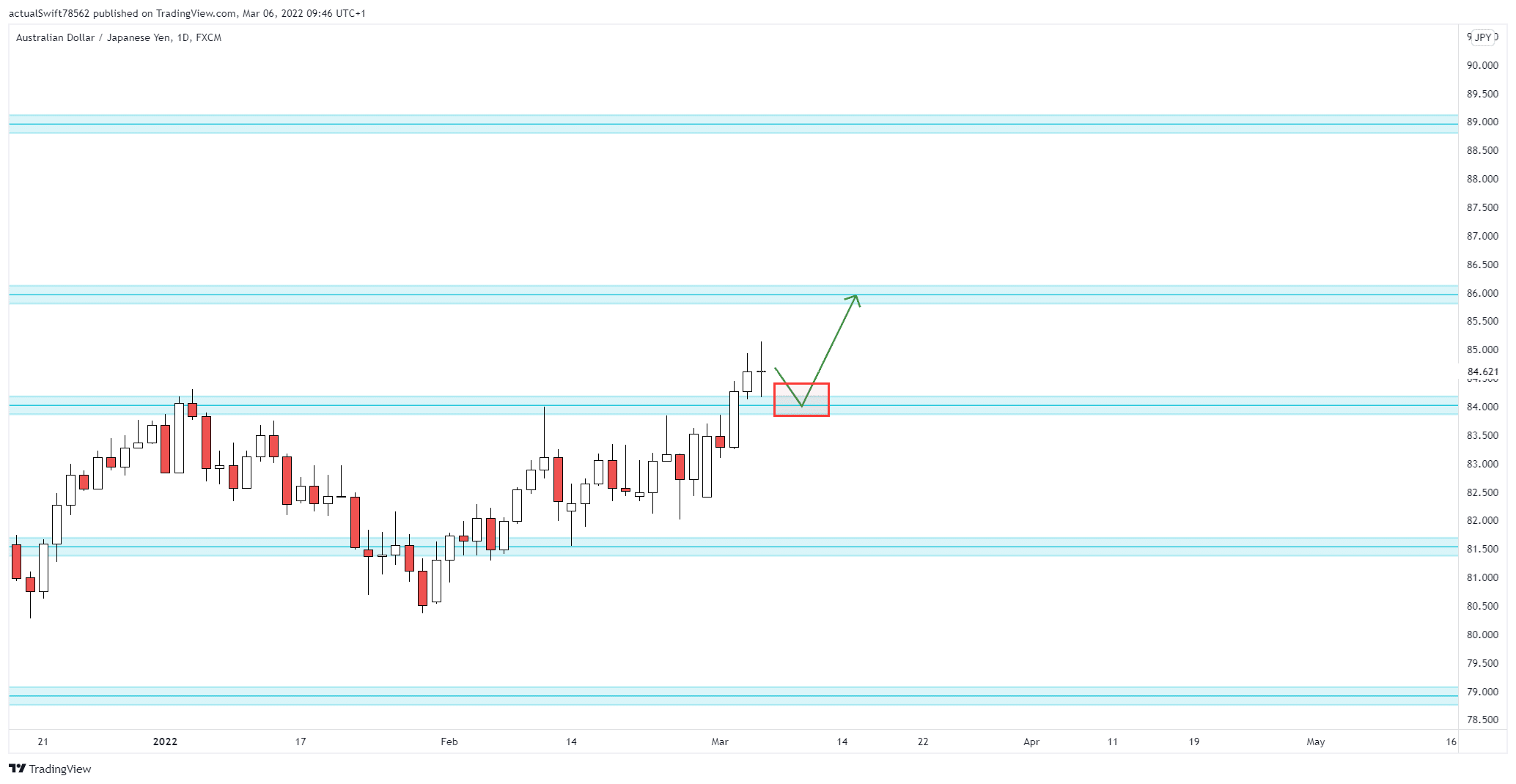

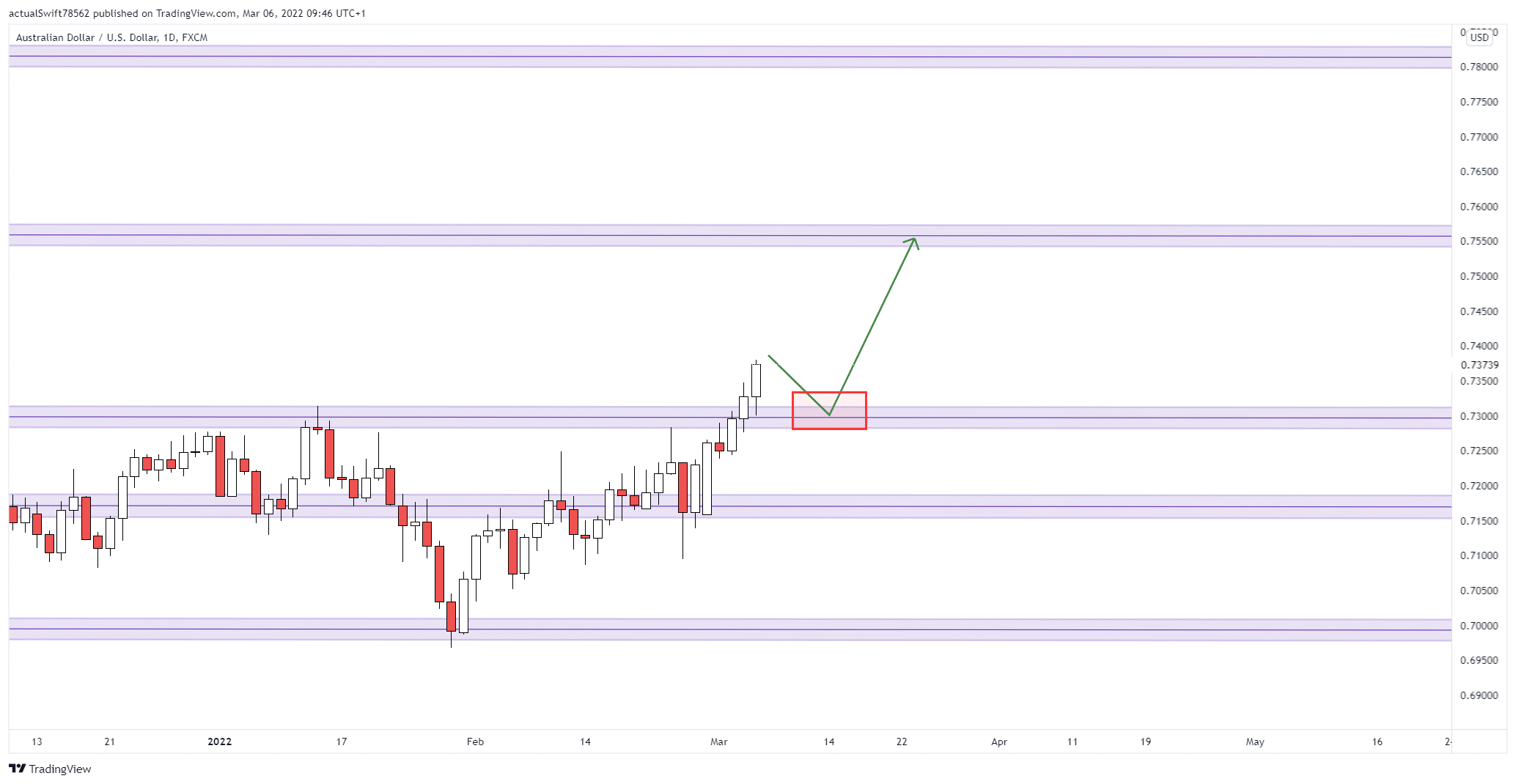

AUD/CAD, AUD/CHF, AUD/JPY, and AUD/USD:

These are all AUD pairs with identical price action. On all the setups we got a break of the resistance area. This week we will wait for pullbacks back into the resistance areas, now turning support. If we get good price action at the areas, we’ll be looking for potential trades long.

Note, as they are all AUD pairs with identical price action. We recommend that you only enter either one of them or you spread your risk among them.

AUD/CHF:

AUD/JPY:

AUD/USD:

EUR/USD:

The previous week, we saw strong bearish momentum on this pair. We want to trade with this momentum, so we will wait for the price to push slightly lower and then make a pullback. If that happens, we’ll look for an entry short from the resistance area.

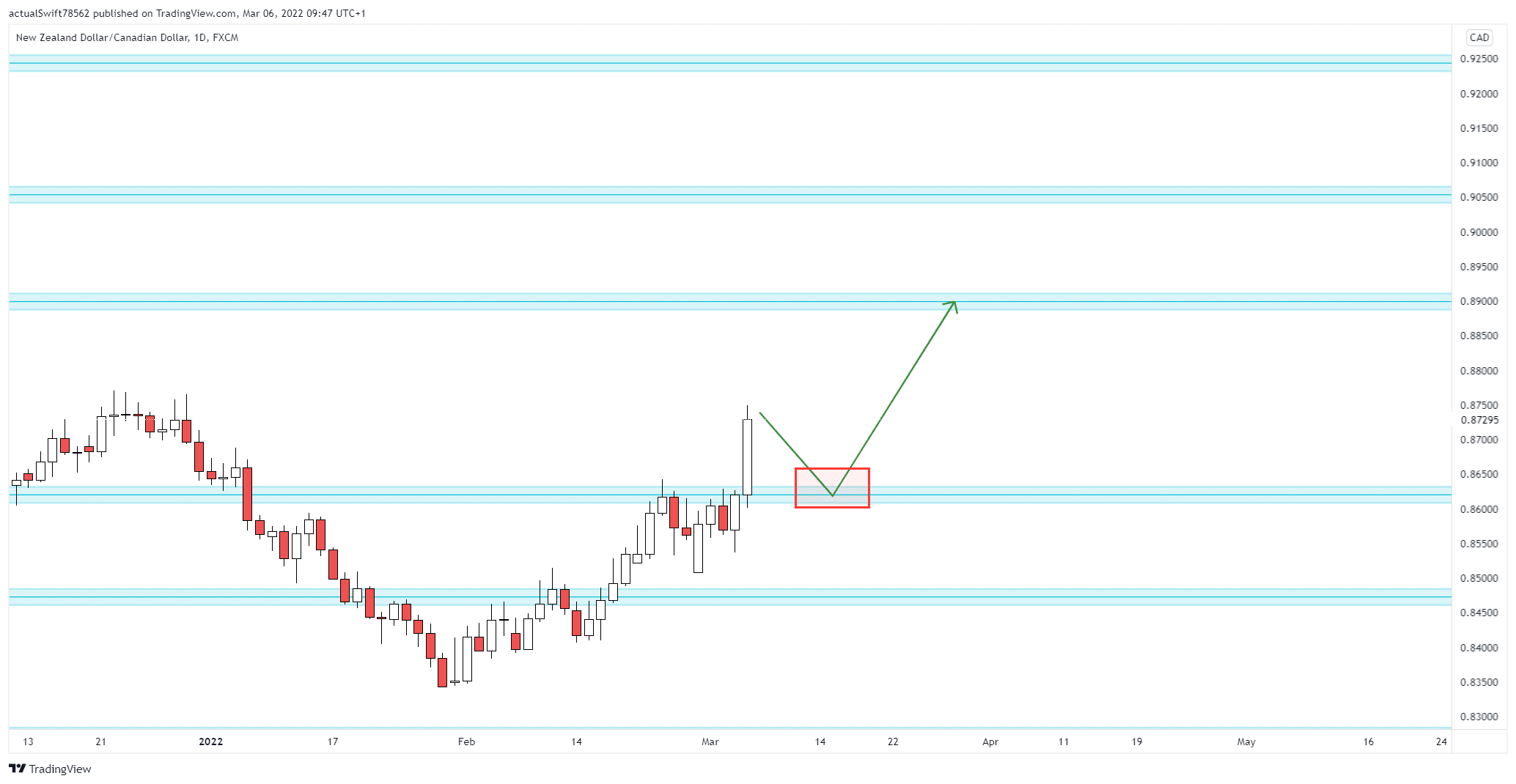

NZD/CAD, NZD/CHF:

We got two NZD potential setups with identical price action.

After the price broke the resistance area, we will wait for a pullback and a potential entry long.

NZD/CAD:

NZD/CHF: