Hello guys, welcome to this week’s market analysis where we cover the setups that we are looking at for the upcoming week.

Weekly trade ideas and analysis:

This week we have a couple of setups that we really like and will most likely trigger on Monday or Tuesday. But please note that a lot of the currencies repeat, so we suggest you either only enter one or spit the risk among them.

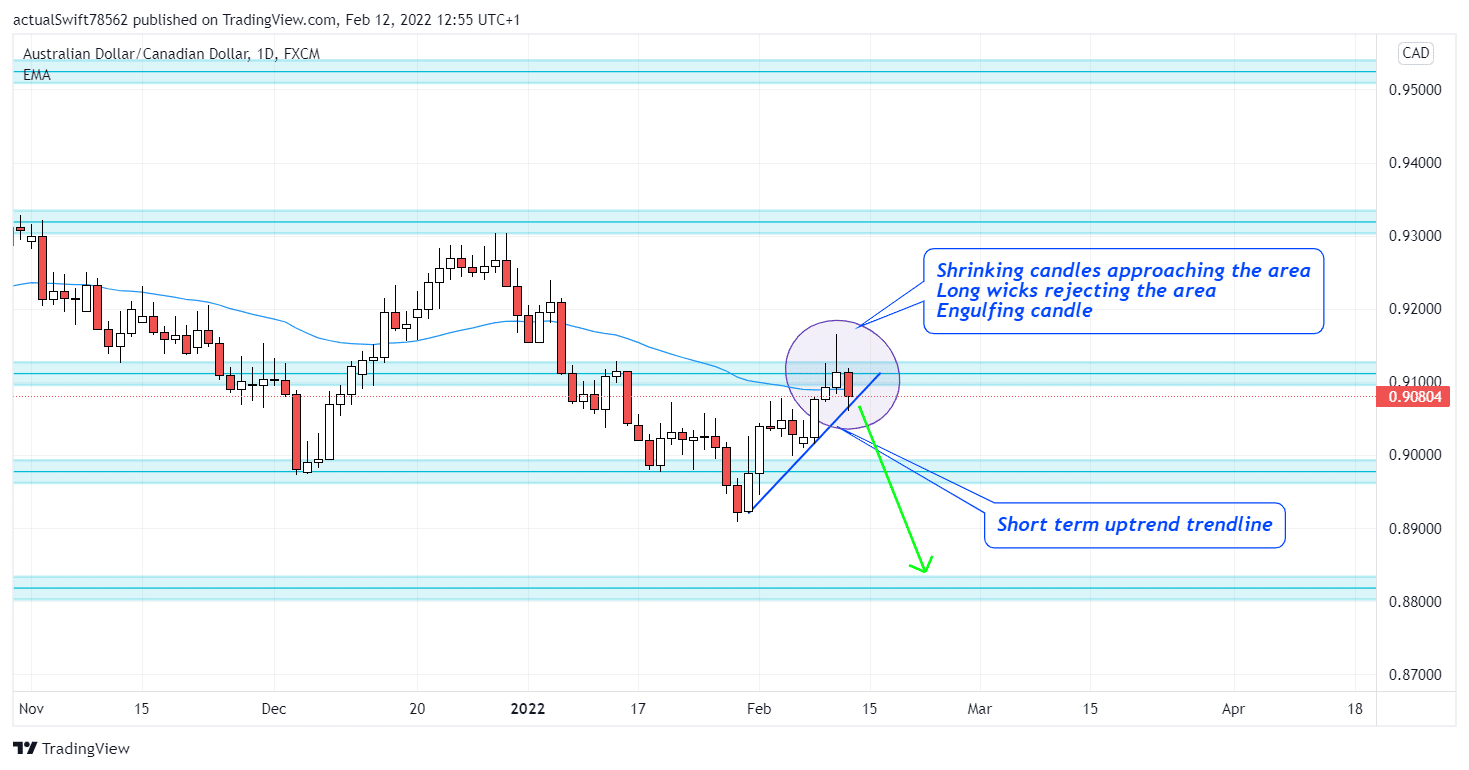

AUD/CAD:

The first setup that we will most likely see trigger is AUD/CAD.

The price here has been moving down slowly for a year now. So, this is a perfect scenario for a short trade. A great opportunity appeared when the price pushed back up to a very strong resistance area, that also aligns with the 0.61 FIB area.

We see that as the candles approached the area they started shrinking, which signals a loss of momentum and we also got long wicks rejecting the area. And to top it all off, on Friday we got a nice big engulfing candle. Those are all great bearish indicators and that is exactly what we are looking for.

As you see, we have drawn in a trend line on the short-term uptrend. As soon as the price breaks and closes below the trend line, that will be our entry signal and we will look for an entry short.

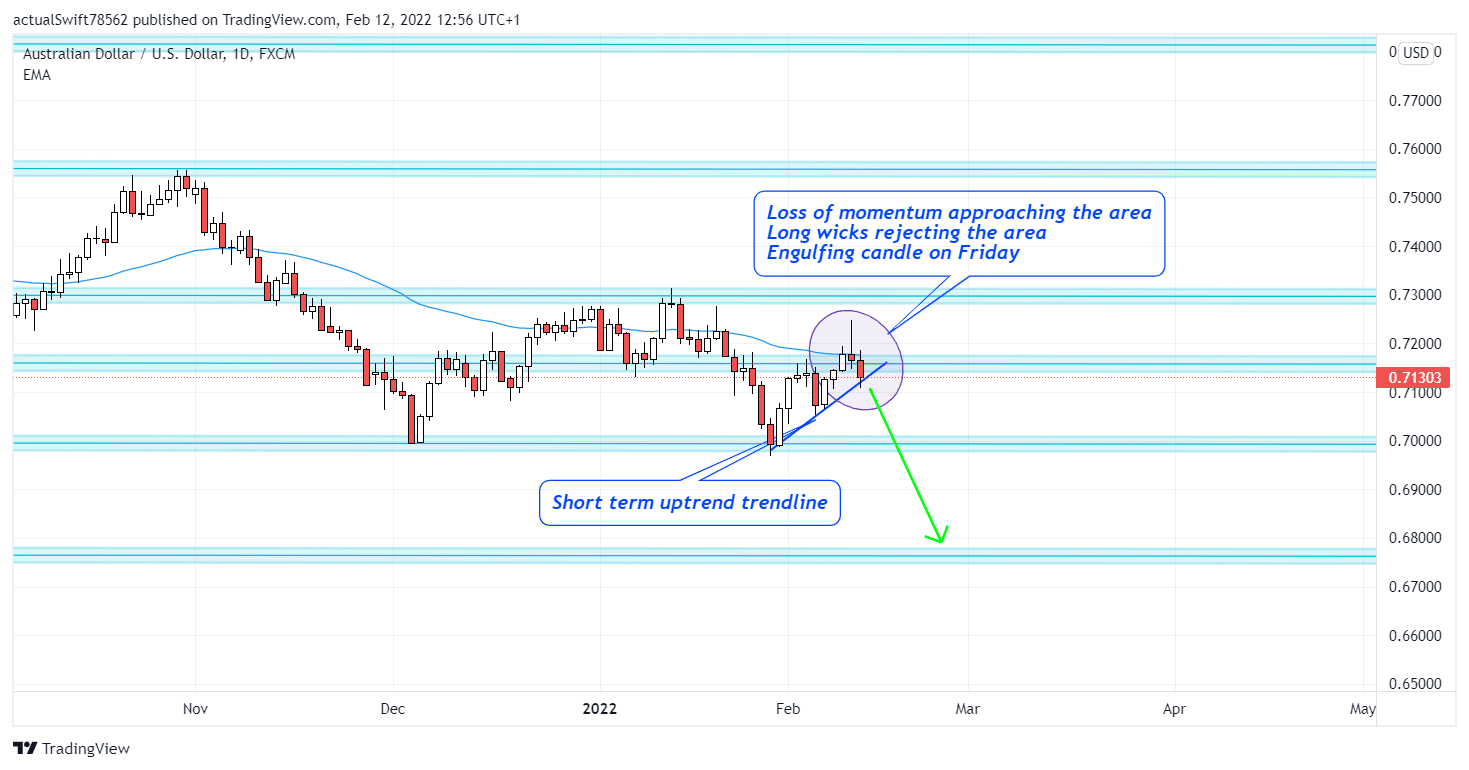

AUD/USD:

The story here is exactly the same as on AUD/CAD.

We have an identical long-term downtrend, identical loss of momentum approaching the resistance area, long wicks rejecting the area and the same engulfing pattern.

That is why we recommend you either only enter one or split the risk:

NZD/CAD:

The story with the NZD pairs is very similar to our previous AUD pairs.

The price is overall in a downtrend. We see that it has made a pullback back into a strong resistance area that also aligns with the 0.61 FIB area. That makes for a great area to trade from.

We are seeing shrinking candles approaching the area, as well as multiple wicks rejecting the area topped off with an engulfing candle on Friday. Those all show a loss of bullish momentum and indicate the presence of bears, which is exactly what we want to see when we trade short.

Our entry here will be the same as previously. Once we get a break and close below the short-term uptrend trend line, we will start looking for entries short.

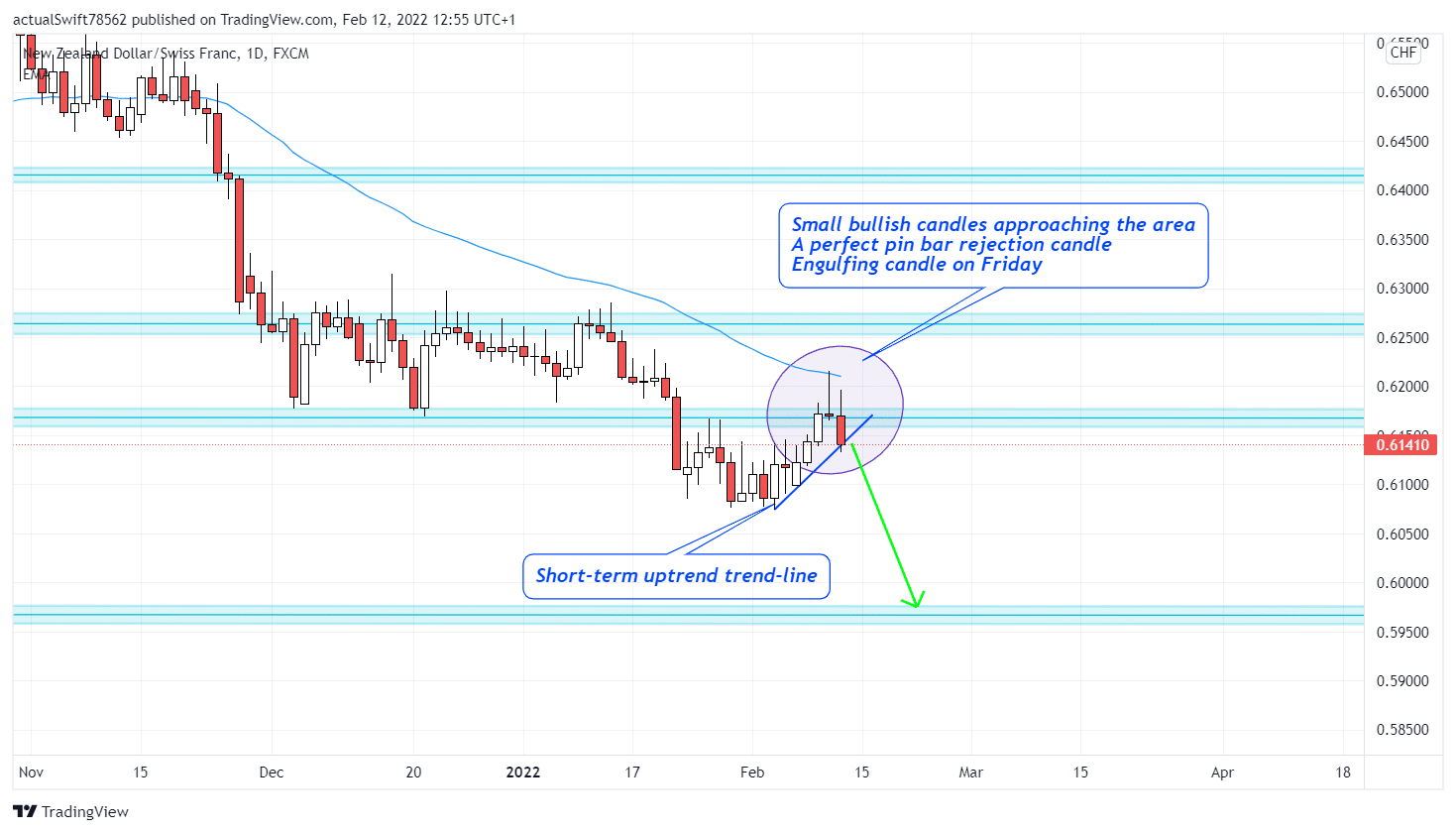

NZD/CHF:

And again, the same story as on NZD/CAD. Overall, we are in a downward trend. We got a pullback that aligns with the 0.61 fib area. We have long wicks rejecting the area along with an engulfing candle on Friday.

If we get a break of the short-term uptrend trend-line, we will start looking for trades short.

Refer to NZD/CAD for a more theral explanation.

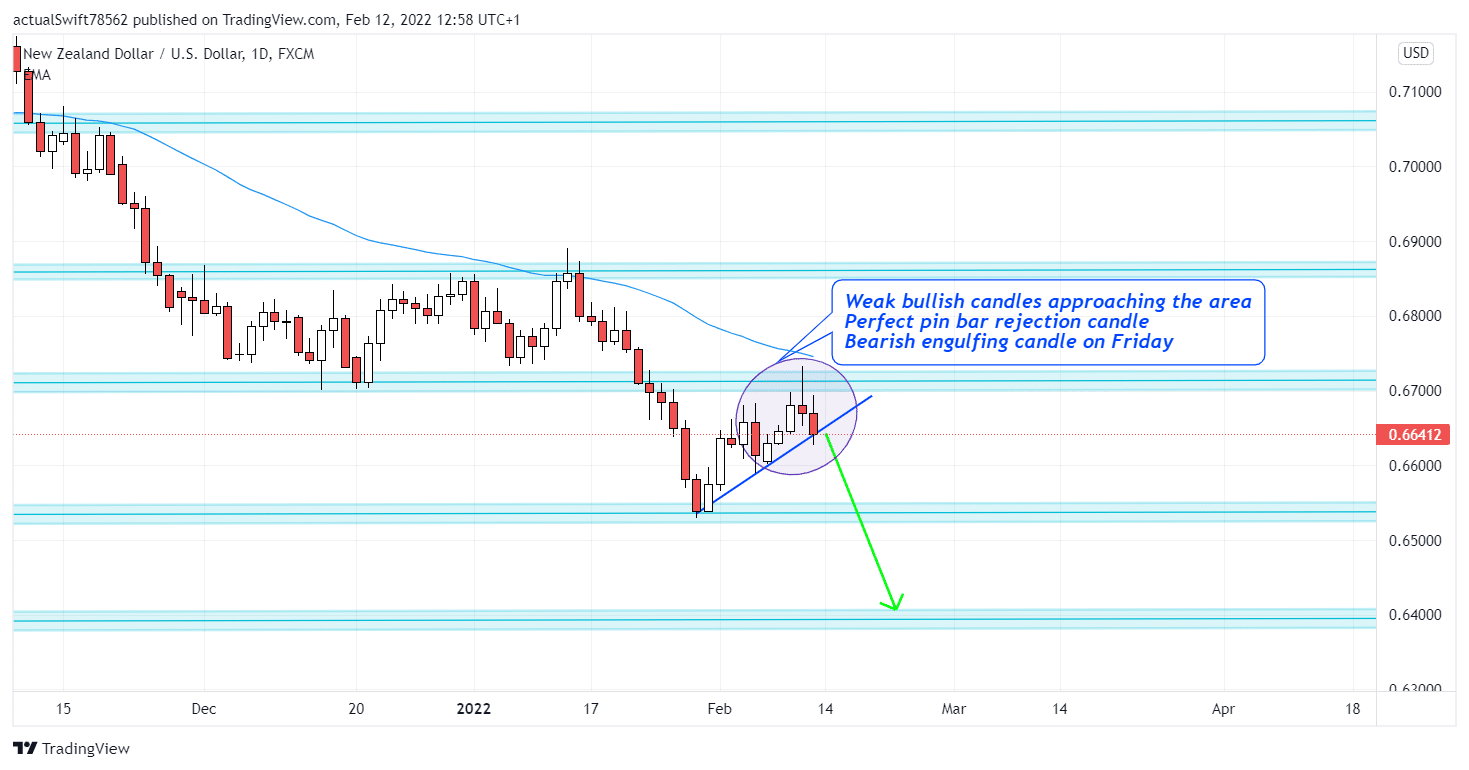

NZD/USD:

This setup is the same as our previous two setups.

We are overall in a downtrend. The price has recently made a pullback back into a strong resistance area. As the price approached the area, we got shrinking candles and a perfect pin bar rejection candle topped off with an engulfing candle on Friday.

Our entry will be the same here as well. When we get a break and a close below the short-term uptrend trend-line, we will start looking for an entry short.